No time to buy groceries after work? No worries, online shopping can do just about anything. On one particular island, it's been commonplace for much longer than in other developed eCommerce countries: we're talking about the United Kingdom.

Online Grocery Shopping Has a Long Tradition in the UK

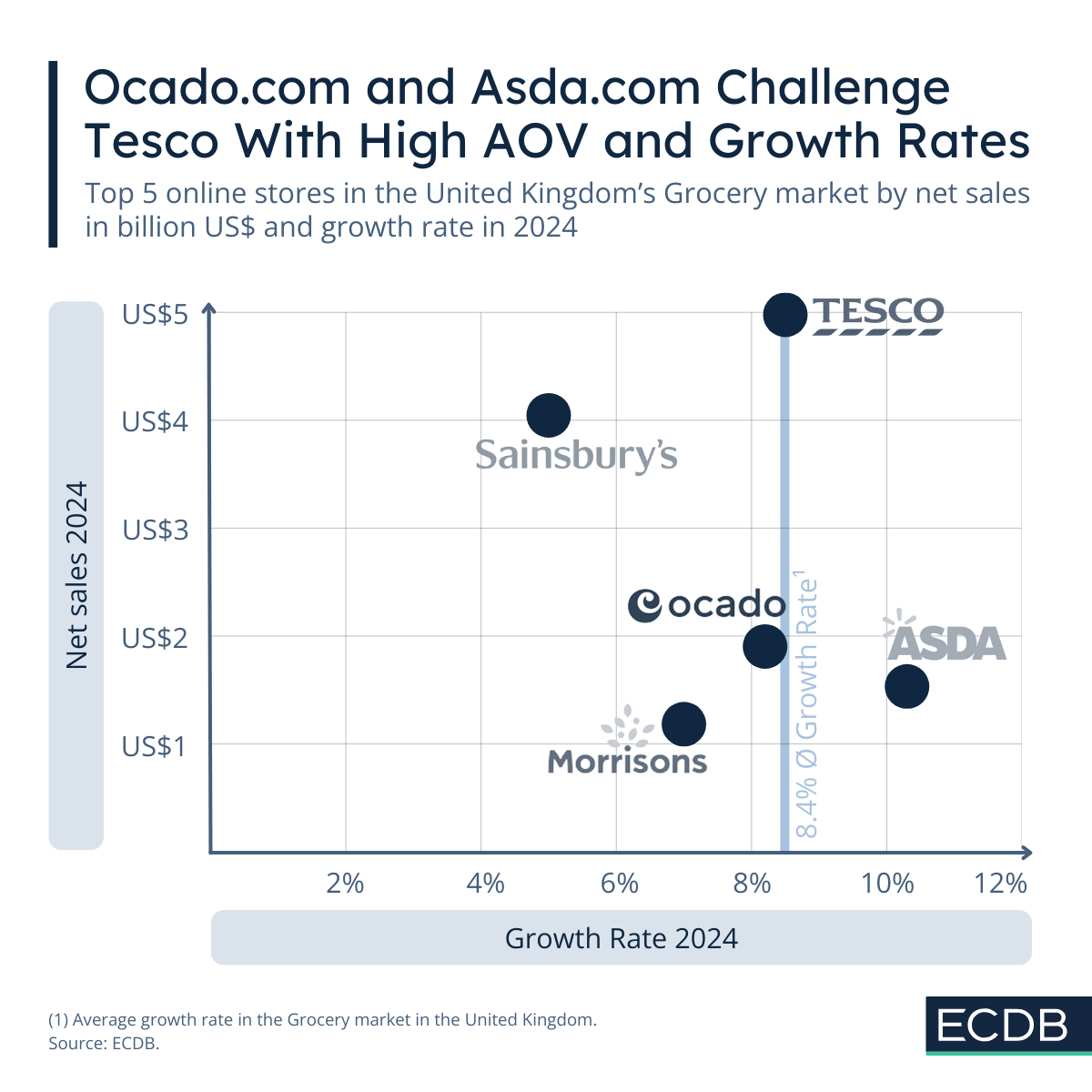

If there is one thing the United Kingdom is good at in eCommerce, it is certainly supermarkets and Grocery. A glance at the leading online stores in the UK reveals that – after the generally dominant online store amazon.co.uk – most of them are online grocers. Online supermarkets already have a longer history in the UK: Tesco Plc, J Sainsbury Plc and ASDA Stores, Ltd., for example, expanded their online influence back in the 1990s – one could say they are the OG's in this segment.

The former has been online since 1994, and last year generated almost US$5 billion in grocery net sales – 63.5% of its total net sales. This puts tesco.com as the number one online grocer in the UK. Although the growth rate of 8.5% in 2024 is slightly above the average growth rate, ECDB analysts expect a further decline from once 11.6% in 2023 to 3.5% in 2025. For other online shops, this could be an opportunity.

Ocado Shines With an US$150 Average Order Value

An online store specializing in Grocery shopping with future potential is ocado.com. The online retailer has a remarkably high AOV of US$150, which includes purchases across all product categories via the retailer. In comparison, the leader in this ranking has an AOV of US$117, while the average AOV in the UK amounts to US$118.5. The other top online Grocery retailers have even lower AOVs, ranging from US$51 at sainsburys.co.uk to US$57 at asda.com and US$58 at morrisons.com.

So why does ocado.com have such a high AOV? The online-only store is owned by the Marks & Spencer Group Plc, which specializes in product development, and the Ocado Group, which focuses on technology and logistics. This combination enables ocado.com to offer a wide range of products beyond groceries. M&S provides the online retailer with products such as Care Products and Fashion at a higher price point than typical supermarkets, increasing the AOV.

The Impact of Ocado on Other Players in the Grocery Market

The Ocado Group was founded in 2000 and over the years has built up a so-called Ocado ecosystem consisting of various Customer Fulfillment Centers. The group partnered with affiliate online stores, among other things in France and the United States to expand its network and make use of cost-saving effects this way.

The UK's fifth-largest online grocer, morrisons.com, which was Ocado's first partnership, is benefiting too. The success of morrisons.com, which generated net sales of US$1.2 billion last year, is partly linked to Ocado – and vice versa. They have managed to cut costs while attracting customers with lower prices and faster delivery – a win-win situation for all.