Amazon is a dominant force in global eCommerce, with a 2023 gross merchandise value (GMV) of US$728 billion — larger than Poland's GDP in 2022.

In the UK, Amazon is especially strong. The country ranks as the world's third-largest eCommerce market, with projected revenue of US$152 billion by 2024. With 8.4% of its GMV coming from the UK, Amazon stands as the undisputed number one in the country.

How does Amazon stack up against other top marketplaces in the UK? Let's take a look.

Top 5 Marketplaces in the UK: Who Are Amazon's Top Competitors?

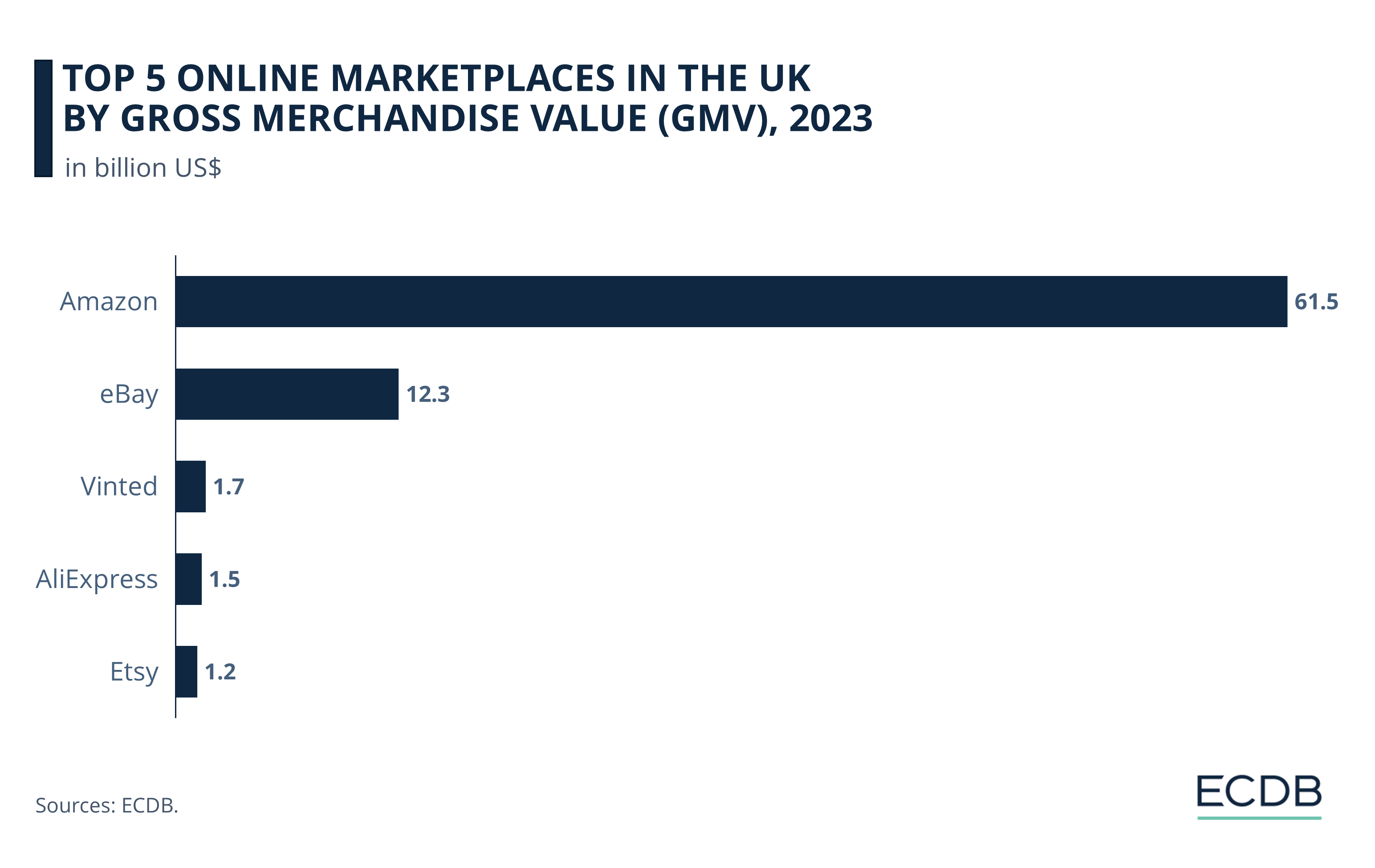

Looking at the top 5 online marketplaces in the UK by GMV in 2023, Amazon's outstanding position in the market is clear:

Amazon leads in terms of GMV (US$61.5 billion) in the UK, with an annual growth rate of 9% and a special focus on the category Hobby & Leisure (37%).

eBay follows with the second-highest GMV (US$12.3 billion), despite a decrease in growth of 1.5%. The U.S. enterprise's main category is Hobby & Leisure (26%).

Vinted holds the third position (US$1.7 billion) with a solid growth rate of 65% in 2023 and a focus on Fashion (84%).

AliExpress (US$1.5 billion) comes in fourth, with a yearly growth rate of 54%. Its strongest category is Fashion (31%).

Etsy ranks fifth (US$1.2 billion). The U.S. business sells Fashion most (42%) and recorded a decline in annual growth (-1.5%).

Statista’s 2023 Consumer Insights uncovered a preference of UK consumers for marketplace loyalty: one third of online shoppers prefer to buy from various sellers on a platform. A satisfactory experience is most indicative of whether customers want to repeat purchase.

One reason why the competition trails so far behind could be the selection of diverse products across a multitude of categories that Amazon offers. There's no category in which the U.S. giant doesn't lead in the UK eCommerce market.

Besides product selection, Amazon's competitors differ in the services they offer, like delivery time, payment method, and customer expectations, where artificial intelligence (AI) plays a growing role.

Despite Losses, eBay Remains the Biggest Rival

Competitors eBay, Etsy, and Vinted are having a hard time keeping up with Amazon and some of them have lost business between 2022 and 2023. The reasons for degrowth can be macroeconomic (like rising prices due to inflation), or platform-specific, such as declining user satisfaction or product range/quality.

The gap between the first and second is widening as eBay shrinks while Amazon grows. eBay entered eCommerce as one of the first and biggest C2C marketplaces. Like many eCommerce companies, eBay benefited from the COVID-19 pandemic, but post-pandemic trends and projections for the coming years show that eBay continues to lose engagement and revenue.

Despite this negative development, eBay remains the second largest marketplace in the UK. The question is, for how long?

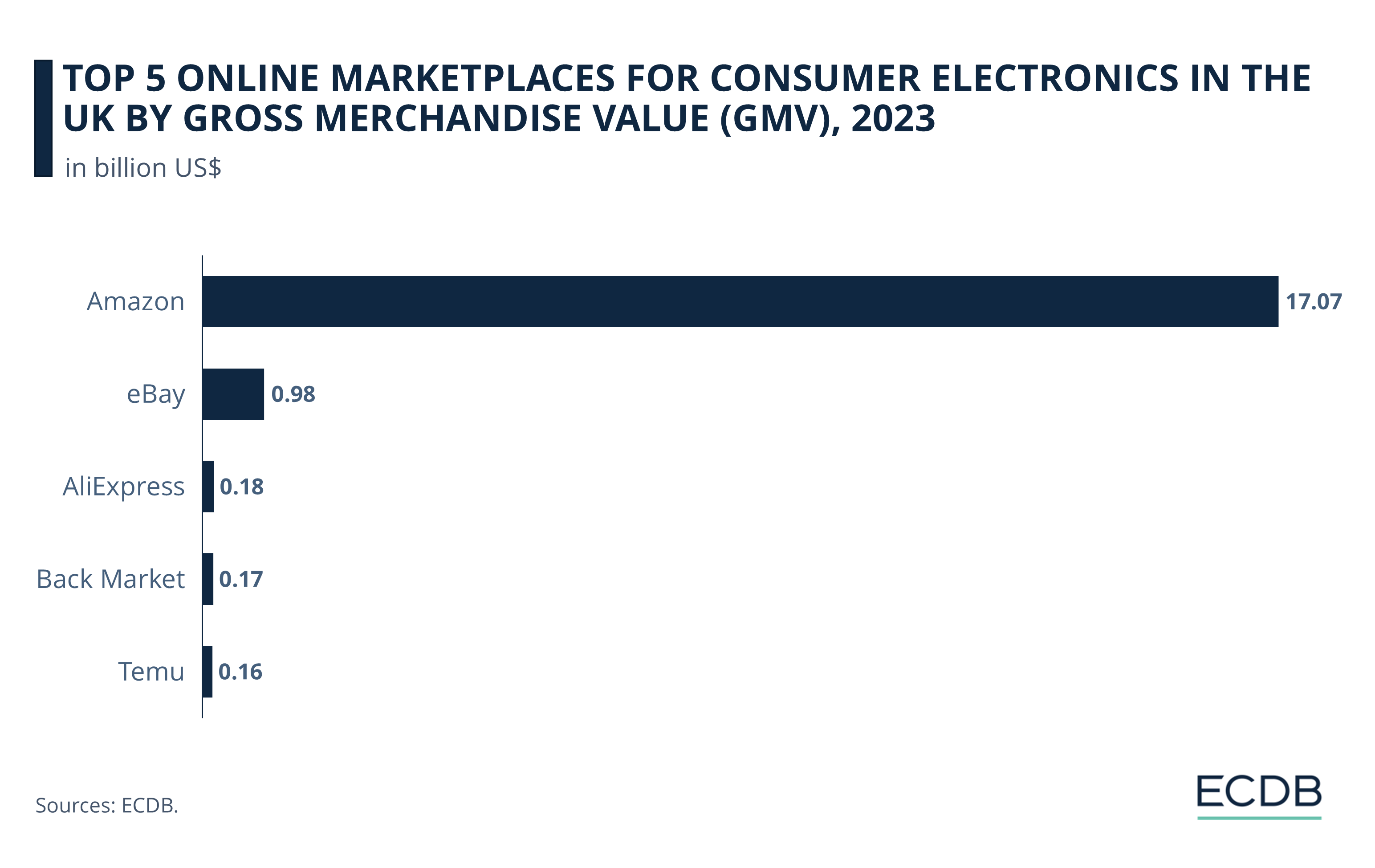

UK’s Largest Marketplaces for Consumer Electronics: Clear Amazon Dominance

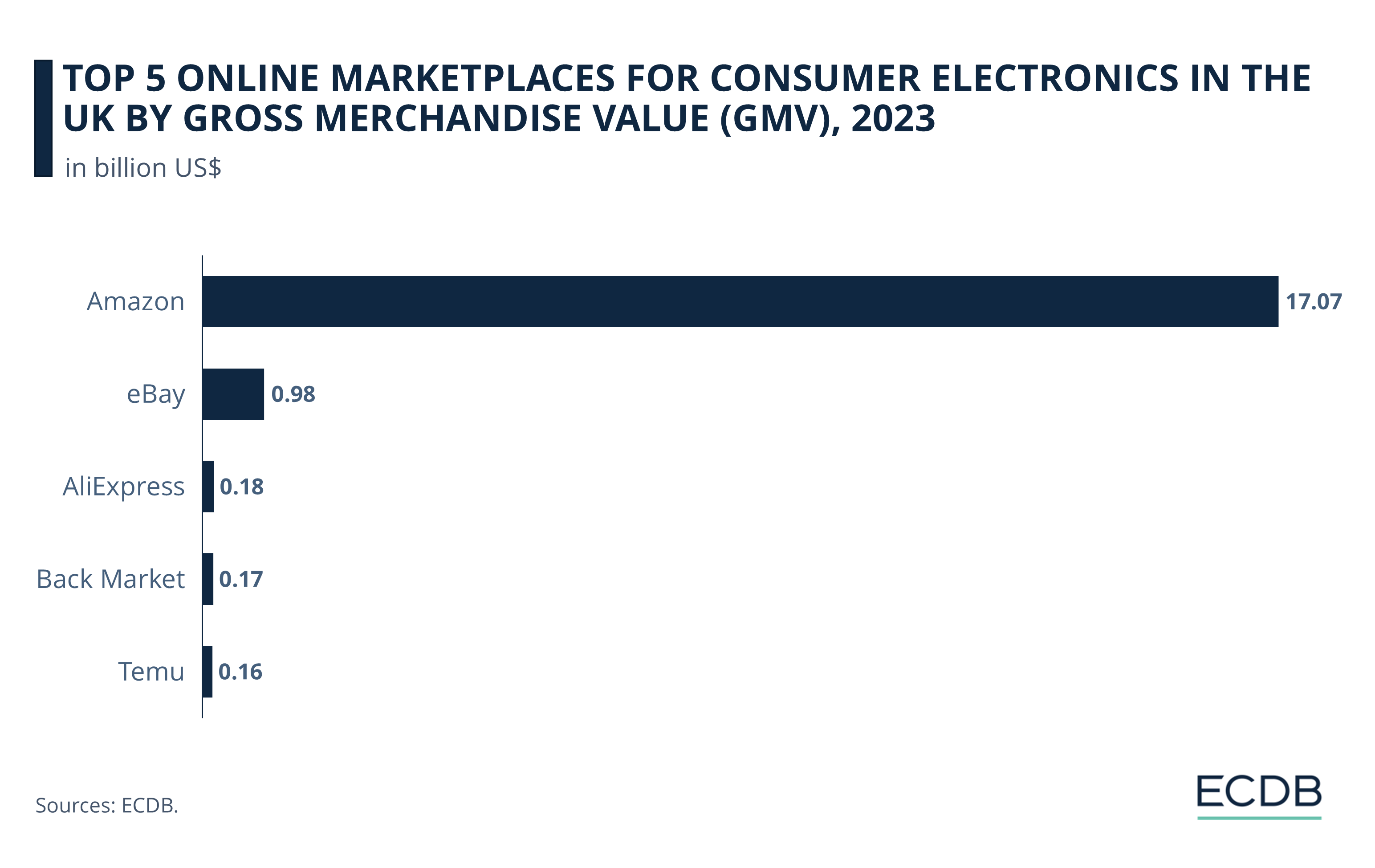

Consistent with the company's outstanding position, Amazon is the primary marketplace for consumer electronics in the UK, as seen below.

Consumer Electronics worth US$17.07 billion were sold on Amazon in the UK (2023).

Following further behind at about 5% of that is eBay (US$987 million).

The remaining platforms fall far below the US$1 billion mark: AliExpress with US$182 million worth Consumer Electronics sold in the UK in 2023, Back Market with US$174 million and Temu with US$167 million.

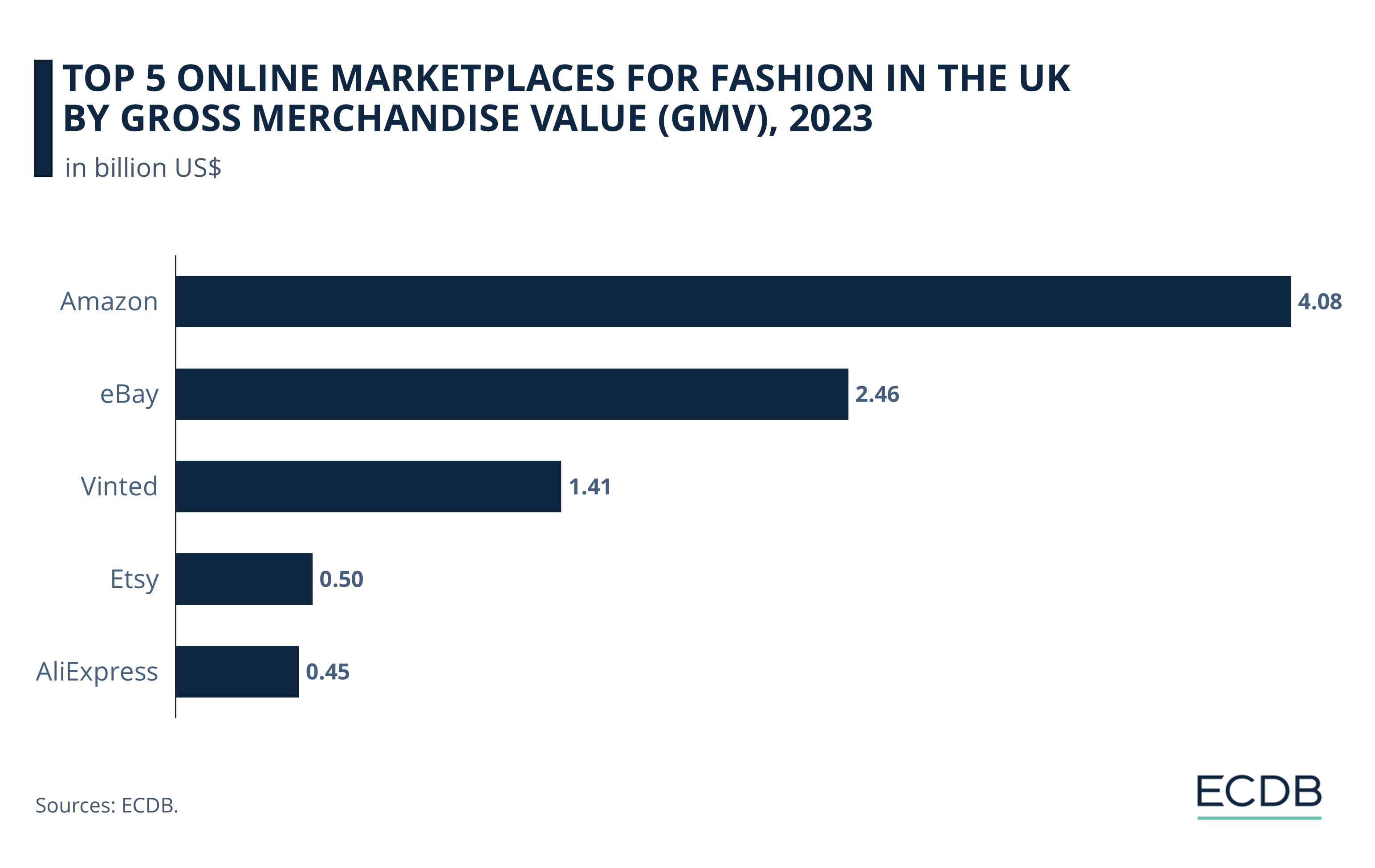

UK’s Largest Marketplaces for Fashion: eBay (Relatively) Close Behind Amazon

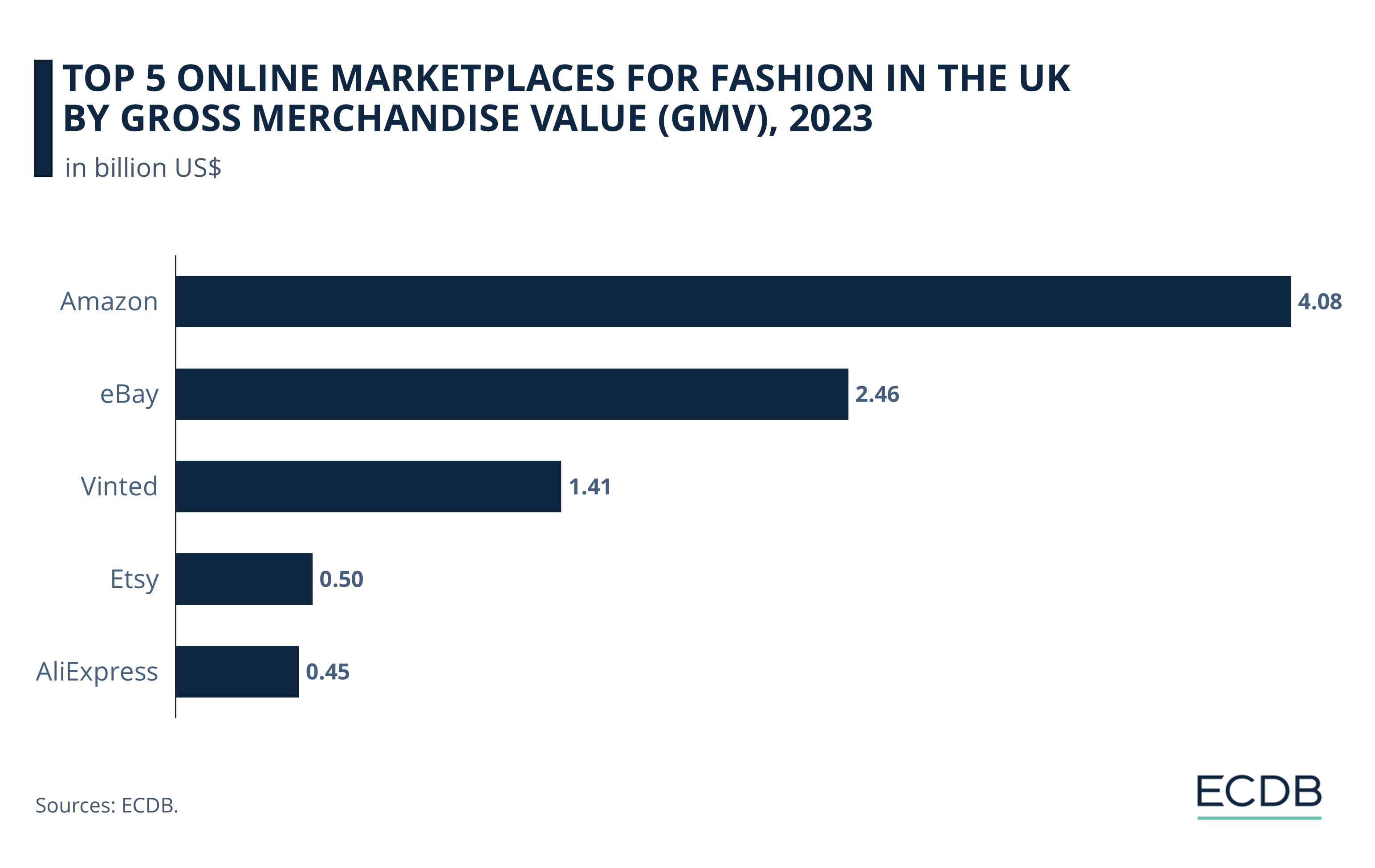

There are also categories in which Amazon does have a smaller head start, providing the competition with avenues for attack, such as the fashion segment.

Although eBay's main share lies in the Toys, Hobby & DIY segment, it performs remarkably well in the fashion category.

The difference between Amazon and eBay is now around US$1.6 billion, which is less than for electronics, where the difference reached into US$16 billion.

The other top marketplaces for fashion in the UK include Vinted, Etsy, and AliExpress.

Overall, it is clear that companies from the United States and China are striving for top positions in the UK, while UK companies tend to rank lower. Occasionally, European companies like Back Market or Vinted make it into the top five, but no one can hope to match Amazon's level.

Amazon Strategy: Prime Days, Black Friday, Cyber Monday

To sustain one's growth in times of inflation and geopolitical conflicts, it is helpful to promote purchasing incentives. Amazon achieves this by offering special discounting events such as Prime Days and Black Friday.

Although Amazon typically does not release exact sales figures of the Prime Day, Adobe has estimated the sales figure Amazon generated on its Prime Day in July 2023. It is evident how such special events significantly contribute to Amazon's success by ultimately increasing sales and profitability.

Black Week encourages people to make purchases on all retail platforms, not just Amazon. A growing number of sellers, whether online or offline, try to capitalize on this shopping day. Particularly in regions where holidays are celebrated at that time, this week provides affordable opportunities to purchase gifts for family and friends.

Top Amazon Competitors in the UK: Closing Thoughts

While it is clear that Amazon is the leading marketplace by GMV globally and in the UK, it is particularly strong in consumer electronics. Although it is also the most popular marketplace for fashion, other platforms generate relatively high GMVs, notably eBay.

However, the recent emergence of low-cost platforms with a similar product variety is putting pressure on Amazon as its problems become more apparent. The marketplace's dominance is still strong, but other contenders are waiting to challenge its leadership at the right time. Whatever the outcome, ECDB provides the data and analysis.