Fashion – whether for functional reasons or to keep up with the latest trends, we all buy it. No wonder, given that clothing is a universal need. Over US$95 billion was generated in this category last year, representing 27% of global eCommerce sales. This makes Fashion by far the largest product category in eCommerce.

Fashion is a highly trend-driven category, and Shein responds to this need for constant novelty by offering consumers quick style changes for a little budget. In the global eCommerce Fashion ranking, this helped Shein become number one.

Top 5 Fashion Online Stores: The Best of the Best

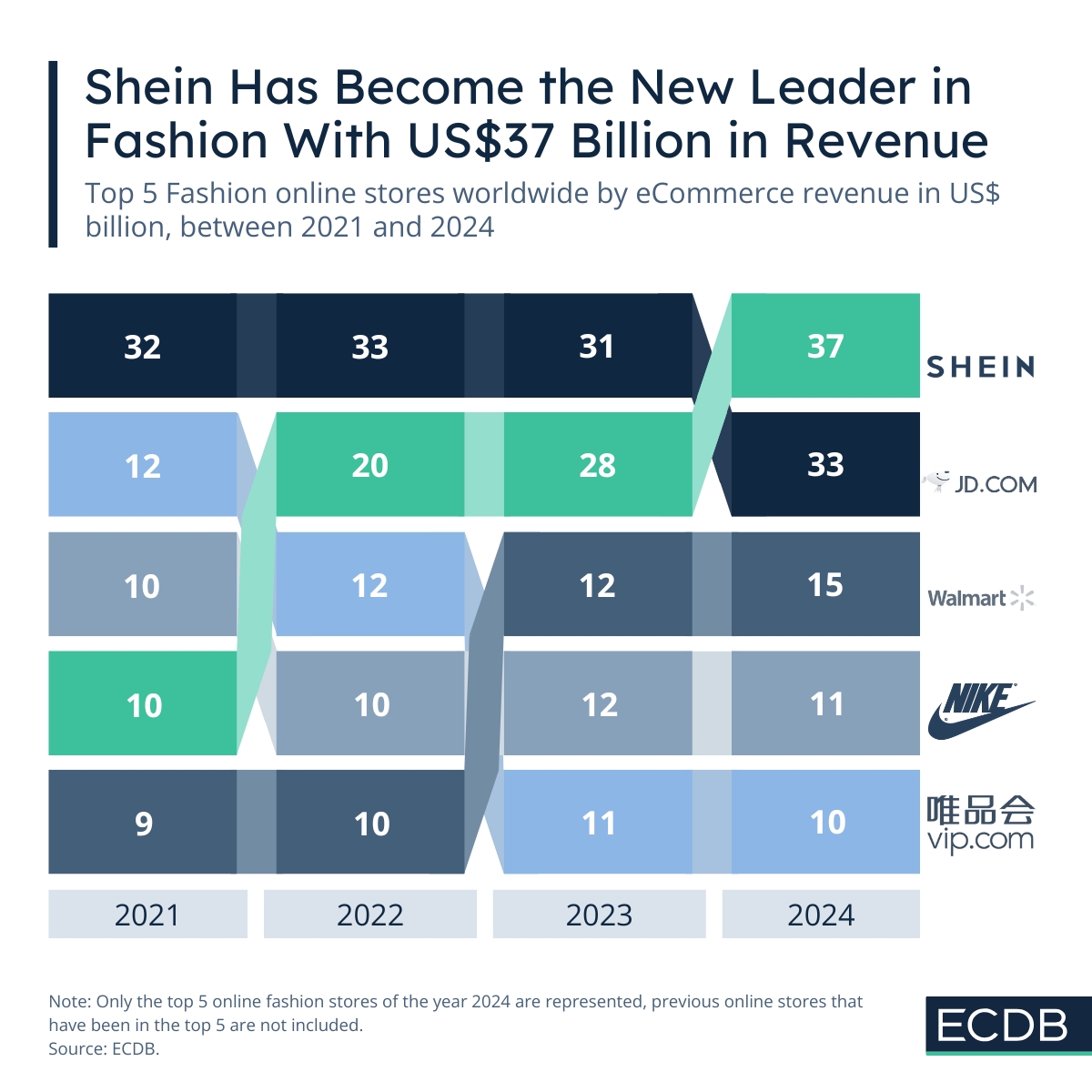

Five online stores have established themselves globally, and their positioning changes annually. On the one hand, there are the U.S. Fashion players with walmart.com and nike.com, which generated US$15 billion and US$11.1 billion in the 2024 Fashion market. On the other side stand the Chinese players with shein.com, JD.com, and VIP.com whose eCommerce revenues reached US$37.1 billion, US$32.6 billion, and US$10.2 billion, respectively. Shein in particular has shown strong development in the last year, but also in general.

In the past five years, the online store has made great strides, from a former US$1.9 billion in 2019 to US$37 billion in eCommerce Fashion revenues last year, with total revenues of US$48.2 billion in 2024. Shein has quickly turned from an unknown store into a fast-fashion revolutionizer, surpassing fast-fashion OG's like Zara and H&M – what's behind this superfast development?

The Rise of Shein and Ultra-Fast-Fashion

In a world where fashion trends are as long-lasting as a freshly brewed coffee on a Monday morning, Shein has succeeded in becoming the new leader in the fashion market. All thanks to ultra-fast-fashion, an extreme version of Fast Fashion. Shein popularized a hyper-reactive system to trends by producing smaller quantities of styles to test the demand for products, allowing them to respond more quickly to those trends.

The superfast concept has its downsides, however: the styles are based on social media, but also on other designers, outdoing other creations, as in the case of Popflex's Pirouette skort. In addition, this business model has a strong negative impact on the environment. While the clothes are much cheaper, the quality and manufacturing process are repeatedly criticized.

What has also contributed to Shein's continued success is its ability to improve and move with the times. In 2023, the company launched a matching marketplace, allowing a wider range of products from other retailers. Nonetheless, the Shein's Fashion store model is not the only one that has led to great global success.

The Different Business Models Working for Success in Fashion eCommerce

The ranking of best-selling fashion players is dominated by generalist retailers. Just look at JD.com and walmart.com: Both can be considered all-rounders, offering a wide range of products from different categories. But they don't just offer more, they help customers find what they want more quickly with sophisticated algorithms and special offers. In Fashion, they don't emphasize going with trends, but offering customers the basic items they know they wear.

Overall, Shein's concept, with its focus on ultra-fast fashion, continues to find success. But generalist online stores like Walmart and JD.com are also keeping people's attention, while brands like Nike.com are struggling to keep up with the cheaper alternatives. In eCommerce in particular, diversification has paid off, with many of the top 5 making it.