Vinted’s Winning Formula: Fashion, Logistics, Payments, and the Future of reCommerce

With a CAGR of 60%, Vinted secures its leading position as a Fashion reCommerce player in Europe. Even after over 15 years, the company’s success is far from over.

First Quarter 2025 Financial Report

The development of revenues and gross profit suggests lucrative investments and an improvement in the cost-to-income ratio.

Nadine Koutsou-Wehling

Data Journalist

May 19, 2025

Retailers

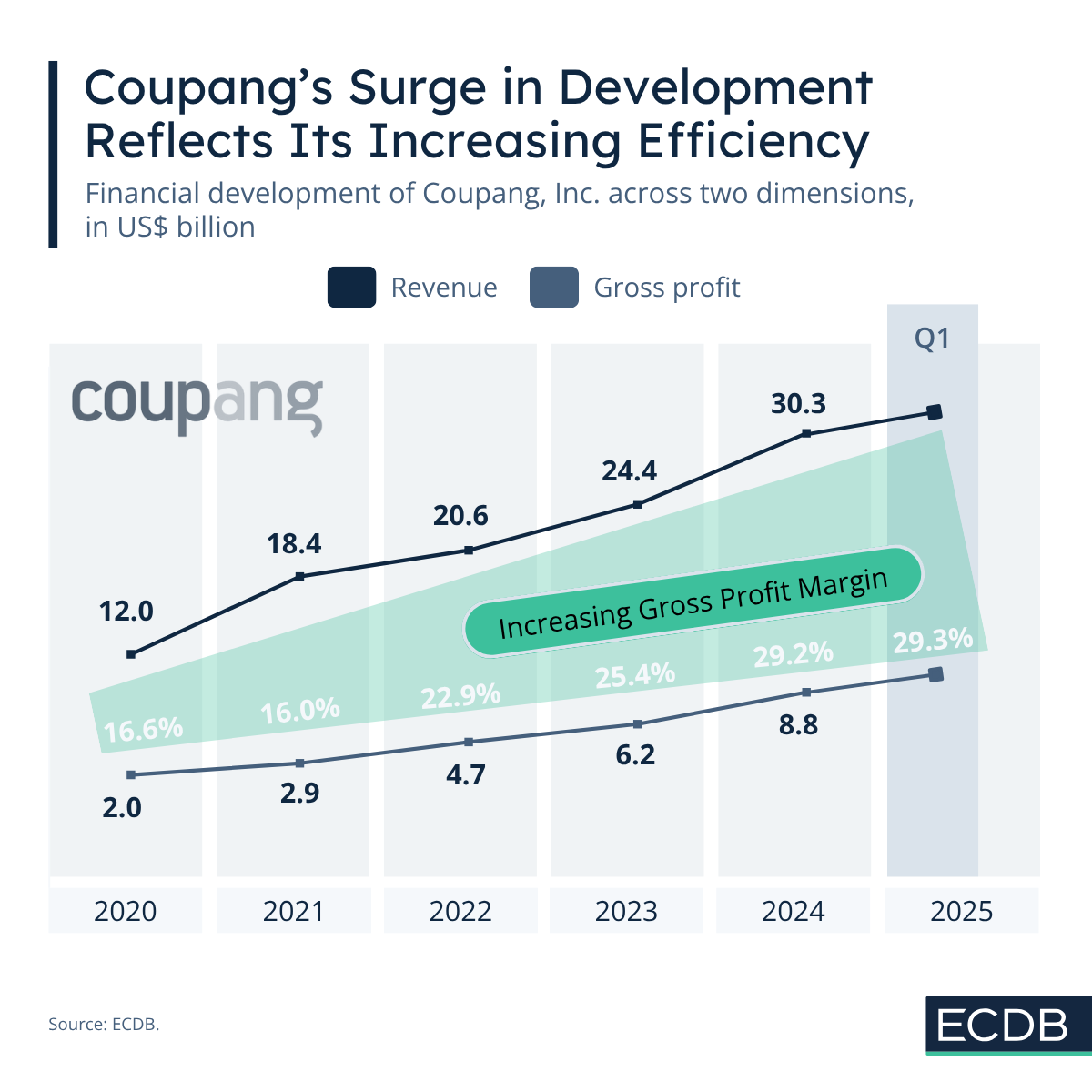

Coupang recently released its financial results for Q1 2025 and business looks good for the South Korean eCommerce leader. In the first quarter of 2025, Coupang reported a year-on-year revenue increase of 21% (on a constant currency basis). On a gross profit level, Coupang achieved a 31% increase, and its gross profit margin has grown as well.

Here is what the numbers tell about Coupang’s business approach and in how far they align with ECDB predictions for the year.

In another blog post on Coupang’s dominance in South Korea, ECDB identified Coupang as a customer-centric and asset-heavy business. This means that it heavily invested in services which make it stand out as an eCommerce retailer, like speed of delivery, availability of products and price competitiveness.

This approach is visible in its financial development, most precisely revenue related to gross profit. The two relate in the sense that gross profit measures the efficiency of operations, or how much profit is made after accounting for the expenditure it takes to cover production costs.

Visually, when the gross profit margin widens, a company becomes more efficient in production, as the costs per unit decrease. This is evidently the case with Coupang.

Coupang has made massive investments in infrastructure and customer retention services, in essence to build up a reputation and loyal customer base. Not for nothing is it called the Amazon of South Korea, as its business concept aims at providing consumers with their every whim and fancy.

The progress of Coupang’s gross profit margin illustrates how over time theCoupan share of gross profit became larger in relation to company revenues. It is a simple economic assumption coming to fruition here, which is that scale drives efficiency: as fixed costs are spread across a growing volume of sales, the company retains more from each dollar earned.

So what do the financials say? Coupang generated revenues of US$12.0 billion in 2020 and a gross profit of US$2.0 billion, which means that its gross profit margin was 16.6% in that year (note rounding differences). It managed to increase both these key performance indicators (KPIs) steadily over the course of the next years, resulting in revenues of US$24.4 billion and gross profit of US$6.2 billion by 2023. In relation to this, gross profit margin was 25.4% in that year.

Up until then, Coupang’s net income has been negative. Basically, all the other associated expenses of Coupang’s operations exceeded the revenue it generated, which is why it was unprofitable. But 2023 was the first year in which Coupang achieved positive net income.

Together with a consistently improving gross profit margin, this indicates that Coupang’s asset-intensive strategy has become increasingly efficient over time. In the first quarter results of 2025, Coupang reported a gross profit margin of 29.3%, which is a 2-percentage point increase from Q1 2024.

The bottom line is this: Coupang is on the profitable path. Considering its market position at the moment, the development is not expected to slow down anytime soon. The recently discussed proposition of Coupang’s acquisition of luxury marketplaces, in this case Farfetch, YOOX and Net-a-Porter, has not had negative consequences on its financials so far.

Related Articles

With a CAGR of 60%, Vinted secures its leading position as a Fashion reCommerce player in Europe. Even after over 15 years, the company’s success is far from over.

Etsy is selling Reverb, the secondhand music gear platform it acquired in 2019. The sale reflects Etsy's declining revenues over recent years, so how is the sale going to affect business?

Temu, the budget-friendly online marketplace owned by PDD Holdings, has exploded in popularity with its F2C business model. The U.S. and European markets are key regions.

Click here for

more relevant insights from

our partner Mastercard.

Our Tool

We’re not just another blog—we’re an advanced eCommerce data analytics tool. The insights you find here are powered by real data from our platform, providing you with a fact-based perspective on market trends, store performance, industry developments, and more.

Analyze retailers in depth with our extensive Retailer dashboards and compare up to four retailers of your choice.

Learn More

Combine countries and categories of your choice and analyze markets in depth with our advanced market dashboards.

Learn More

Compile detailed rankings by category and country and fine-tune them with our advanced filter options.

Learn More

Discover relevant leads and contacts in your chosen markets, build lists, and download them effortlessly with a single click.

Learn More

Benchmark transactional and conversion funnel KPIs against market standards and gain insight into the key metrics of your relevant market.

Learn More

Our reports provide pre-analysed data and highlight key insights to help you quickly identify key trends.

Learn More

Find your perfect solution and let ECDB empower your eCommerce success.