Germany’s eCommerce market is the sixth largest in the world. Its leading retailers influence European online markets, and trends rarely stay within borders. This is why the collaborative study between ECDB and EHI Retail Institute is so significant. This year marks the 17th cycle of the report.

Together, we map out German eCommerce development as it happens annually, providing you with the most reliable and extensive data on the online market. This year’s study came out on 30th September, 2025.

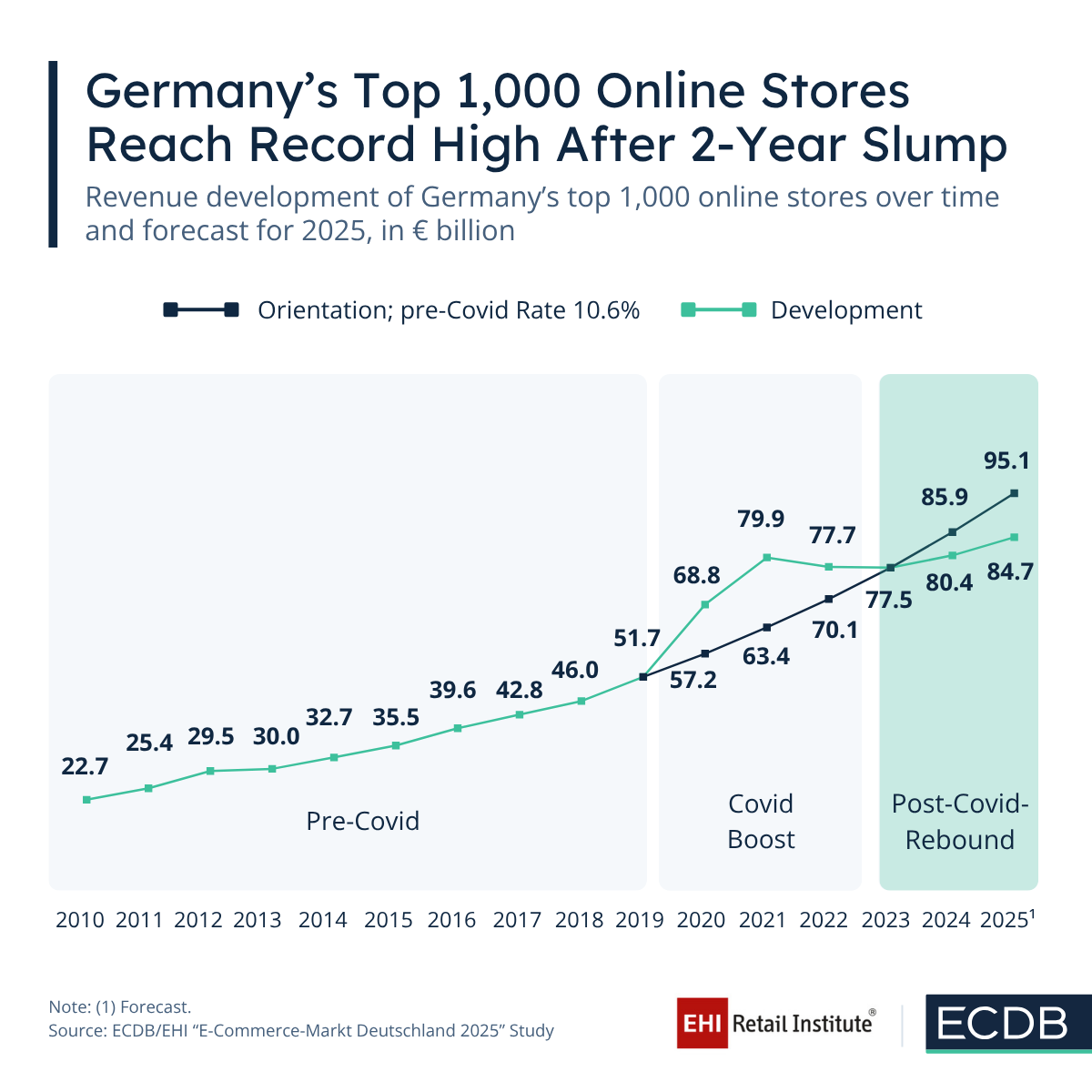

One of the most significant findings of this report is the development of market revenues in recent years. How did the top 1,000 online stores perform? Let's find out!

Post-Pandemic Recovery at Slower Rates of Development Than Before

What’s given in surplus is taken somewhere else, and this rule of thumb also applies to recent years’ eCommerce development. While 2022 was still somewhat above the expected increase based on previous growth rates, actual development fell behind the projected increase by 2024.

In absolute terms, the eCommerce market in Germany reached new record highs since 2024, with a forecast of €84.7 billion in net sales for the top 1,000 online stores in 2025.

Access the complete “E-Commerce-Markt Deutschland 2025” report – your all-in-one guide to one of Europe’s key markets. This exclusive study provides detailed insights on revenue development, market trends, top retailer rankings, and more, including B2C marketplaces, payment methods, shipping, and shop software.

All the essential data is compiled in one clear, convenient report. The “E-Commerce-Markt Deutschland 2025” study gives you the facts you need to make informed decisions and stay ahead. Order your copy today.

Want a quick preview? Check out the EHI/ECDB poster for a snapshot of the most significant findings in Germany’s eCommerce market for 2025.

Macroeconomic Factors, Post-Covid Normalization, Market Maturity

Adding to Germany's weak economic outlook, high inflation, cautious consumer spending and outsourcing of operations to Southern and Eastern Europe, comes the continued importance of physical channels in retail.

The slowdown in Germany’s eCommerce growth after the pandemic is largely the result of Covid-driven demand pulling future growth forward. What it means is that during the pandemic, people switched to online shopping much faster than they normally would have.

Many shoppers who might have gradually moved online over the next several years did so all at once in 2020–2021 because stores were closed and online was the only option. That “used up” part of the growth that would have happened later, so once restrictions ended, there wasn’t as much new demand left to fuel the same pace of expansion.

During lockdowns, consumers shifted online far faster than expected, creating record-breaking sales in 2020 and 2021 but leaving less room for continued rapid expansion afterward. At the same time, the market has matured - most consumers already shop online - so gains now come more slowly compared to the steady double-digit increases seen before 2019.

Covid Peaks Resulted in €79.9 Billion Net Sales by 2021

Until 2019, the development of net sales generated by Germany’s top 1,000 online stores followed a consistent path. Between 2019 and 2021, pandemic net sales surged in comparison to the previous grade of expansion.

The shift placing eCommerce on its head has happened in 2019 and lasted for two years – up until 2021. Hiking from €51.7 billion in 2018 to €68.8 billion 2020 (€11.6 billion above the usual increase) reflects the substantial shift of the economy to online channels. The following year, in 2021, saw an even steeper increase to €79.9 billion, this time €16.5 billion above the regular development.

Everything before that is now labeled the pre-Covid phase. From 2009 to 2018, revenues of the top 1,000 online stores went from €20.0 billion to €46.0 billion.

The development went steady, at a CAGR (2010-2018) of 15.2%. The pandemic disrupted not only the global flow of living as it went uninterrupted for decades, it also led to a surge of eCommerce activity all over the world. Naturally, this includes Germany.