German Market Overcomes 2-Year Slump With €84.7 Billion Net Sales by 2025

The top 1,000 online stores in Germany are set to make €84.7 billion in online net sales by 2025.

ECDB/EHI Collaborative Study in 2025

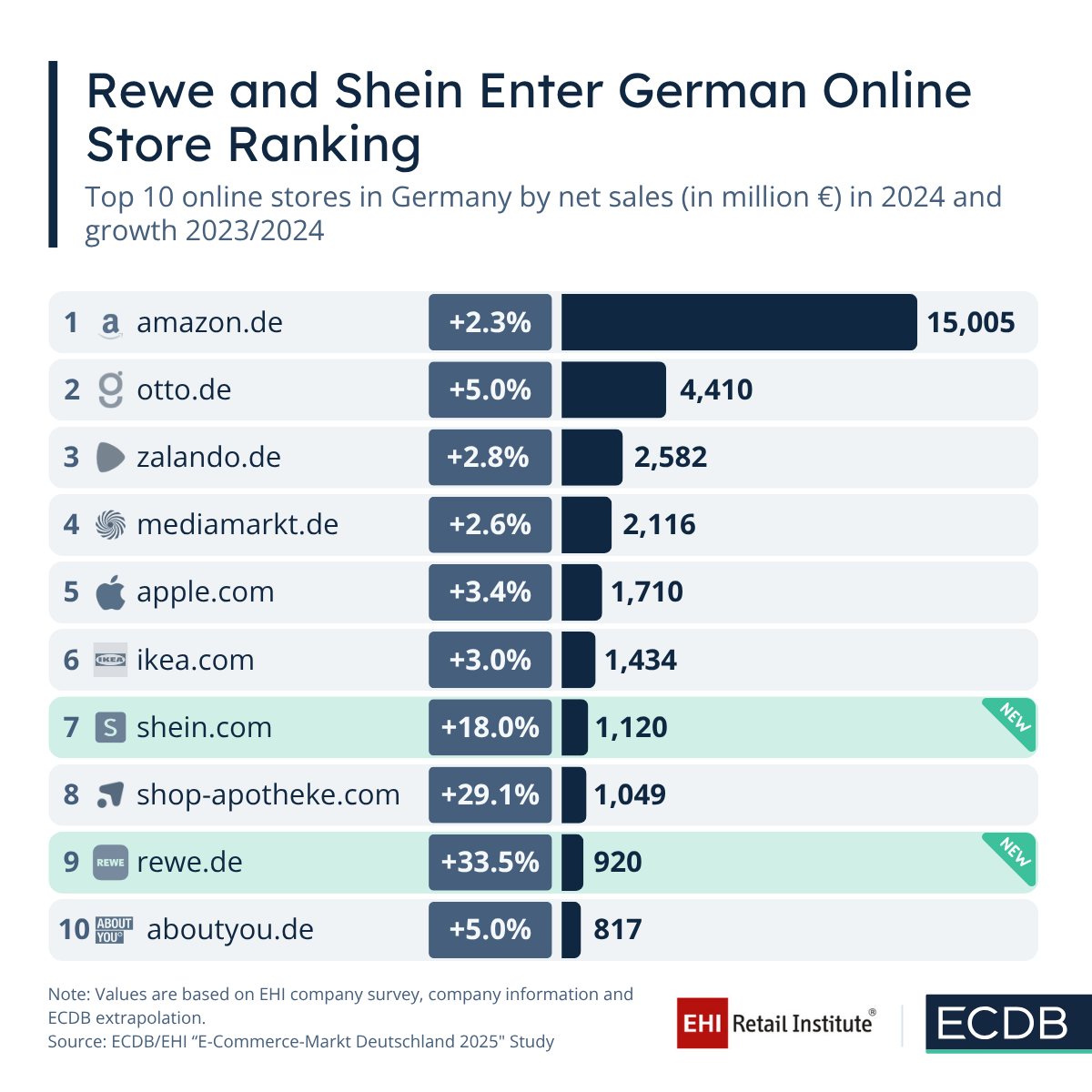

The top 10 online stores in German eCommerce have shifted due to the entry of two players who displaced Lidl and H&M in 2024.

Nadine Koutsou-Wehling

Data Journalist

September 30, 2025

Market Trends

German eCommerce belongs to the most significant contributors to revenue and a major trend driver in Europe. Mapping out its development is therefore relevant across borders. Right now, ECDB published the “E-Commerce-Markt Deutschland 2025” report in collaboration with the EHI Retail Institute.

In this insight, we are going to examine the top 10 online store ranking in German eCommerce. Besides last year's placements, a few new entrants made it into the top 10. Here’s who they are.

In 2024, shein.com and rewe.de entered the top 10 by displacing hm.com and lidl.de, which ended up in lower spots among the top 20. Shein has grown at a rate of 18.0% since 2023, convincing users with a wide assortment at low prices. Similar to Temu, Shein has disrupted world eCommerce with a fulfillment concept cutting out the middleman and reducing costs. With this method, Shein rose to become the 7th largest online store in Germany.

Another climber in German eCommerce is rewe.de: the online store of the popular supermarket chain in Germany achieved a growth rate of 33.5% since 2023. In this way, rewe.de succeeded where lidl.de failed, rising to the 9th spot in German eCommerce with net sales of €920 million.

Shop-apotheke.com was already in the top 10 in 2023, but stood out nonetheless with a 29.1% growth rate in 2024. The online pharmacy generated €1.0 billion in 2024, achieving the 8th spot, up from 10th in 2023.

Access the full “E-Commerce Markt Deutschland 2025” report – your all-in-one resource for understanding one of Europe’s most important markets.

This exclusive report gives you direct access to revenue development and growth, market dynamics and trends, top-performing retailers and rankings, as well as detailed insights on B2C marketplaces, payment methods, shipping, and shop software, among other statistics.

All the insights you need in one clear, convenient document. The “E-Commerce-Markt Deutschland 2025” study gives you the facts to make better decisions and stay ahead. Order your copy today.

Want to have a first look? Here are the most significant findings at a glance in the EHI/ECDB Poster on eCommerce in Germany in 2025.

Apart from these striking changes, another finding of this year’s report is that growth rates have stagnated below 5.0% for the winning positions. This applies to almost all of the top 10 online retailers in Germany in 2023, except for shop-apotheke.com, as discussed above.

Of course, Amazon remains on the top spot, which it has held for decades. In 2025, Amazon generated €15.0 billion in online net sales; however, the stagnation trend also affects Amazon, with only 2.3% growth since the previous year.

Otto’s online store, in second place, has experienced higher growth, reaching 5.0% from 2023 to 2024 and generating online net sales of €4.4 billion. While Zalando and MediaMarkt stayed at the same spots since the previous year, apple.com and ikea.com switched positions. Apple.com grew a little higher with 3.4% than ikea.com with 3.0%, the former generating €1.7 billion in net sales and the latter €1.4 billion.

The race is tight in German eCommerce, with established retailers fearing that upcoming stores may snatch their seats in the top 10 ranking next year. In 2024, lidl.de and hm.com descended the ranking, while aboutyou.de is holding on to the 10th spot. Given its recent acquisition by Zalando, it will be interesting to see how that is going to affect its ranking position in the upcoming year.

Related Articles

The top 1,000 online stores in Germany are set to make €84.7 billion in online net sales by 2025.

By 2026, global apparel rankings are expected to be led by Douyin, sister company to TikTok Shop. At a growth rate of 33.5%, Douyin is set to exceed its rivals in no time.

Shop software providers tend to follow regional distribution patterns. Shopify and Magento are respective number one in half of the world, WooCommerce and others follow. Here are their number one markets located.

Click here for

more relevant insights from

our partner Mastercard.

Our Tool

We’re not just another blog—we’re an advanced eCommerce data analytics tool. The insights you find here are powered by real data from our platform, providing you with a fact-based perspective on market trends, store performance, industry developments, and more.

Analyze retailers in depth with our extensive Retailer dashboards and compare up to four retailers of your choice.

Learn More

Combine countries and categories of your choice and analyze markets in depth with our advanced market dashboards.

Learn More

Compile detailed rankings by category and country and fine-tune them with our advanced filter options.

Learn More

Discover relevant leads and contacts in your chosen markets, build lists, and download them effortlessly with a single click.

Learn More

Benchmark transactional and conversion funnel KPIs against market standards and gain insight into the key metrics of your relevant market.

Learn More

Our reports provide pre-analysed data and highlight key insights to help you quickly identify key trends.

Learn More

Find your perfect solution and let ECDB empower your eCommerce success.