Amazon maintained its dominance in global eCommerce, hitting a record global GMV of US$728 billion in 2023, further widening its lead over competitors.

Competition, however, is fierce. Our data reveals Amazon isn't the only major player in global eCommerce. So, who are Amazon's biggest rivals?

Who are Amazon's Biggest Competitors?

In global eCommerce, China's Alibaba Group emerges as Amazon's biggest rival. It majorly dampened Amazon’s ambitions to expand in what is the world’s leading eCommerce market.

While Amazon still has a larger global market share, the presence of Alibaba-owned marketplaces - such as Taobao, Tmall, and AliExpress - is growing rapidly, particularly in the Greater China region. Taken together, they are outpacing Amazon in the massive Chinese consumer market by a significant margin, each in their own unique way.

For example, Taobao Marketplace, a C2C eCommerce platform, enables small businesses and individual entrepreneurs to open online stores that cater to consumers in Chinese-speaking regions and abroad. Taobao is one of the most popular eCommerce platforms in the world, with over 1 billion product listings and a wide variety of products.

A major driver of economic growth in China, it has also helped create millions of jobs. On the other hand, Tmall, a B2C company, offers lower prices on clothing accessories and computers than Amazon.

Top 5 Online Marketplaces Ranked by GMV

Although numerous companies have taken up the challenge to compete with Amazon, the top competitors to Amazon in terms of GMV all originate in China: Pinduoduo, Taobao, Tmall, and JD.com. These marketplaces possess distinctive selling propositions that differentiate them from Amazon.

Below, we provide the top five ranking marketplaces, ranked by their global Gross Merchandise Volume (GMV) in 2023. We also mention their growth rates, main country of operation, and main product category:

Amazon Inc. (US$729 billion) has the highest GMV, with an annual growth rate (2023) of 9.1%. Predominantly serving the United States (50.2%), their main product category is Hobby & Leisure (37.1%).

Pinduoduo (US$570 billion) has the second-highest global GMV, with a staggering annual growth rate of 24.6%. Exclusively serving consumers in Greater China, its main product category is Fashion (56%).

Taobao (US$506 billion) has the third-highest global GMV, despite having a negative annual growth rate (8%). Serving mainly the Greater China region (95.8 %), its main product category is Fashion (35%).

Tmall (US$501 billion), another Alibaba Group entity, comes in the fourth position. It has a similar annual decline rate (7.6%) to Taobao's and primarily caters to consumers in Greater China (96.1%), with its main product category being Fashion (40.8%).

JD.com (US$501 billion) has the fifth position, with a decline rate of 3%. It also operates mainly in Greater China (99.5%) and specializes in Electronics (45%).

The differences in GMV might be attributed to the types of products and services offered by these platforms. Tmall, for example, offers higher-end products alongside everyday items. JD.com, on the other hand, is known for its fast delivery services, supported by its own warehouse infrastructure. These factors contribute to their respective positions in the Chinese eCommerce market.

Several smaller marketplaces are also making their presence felt in the eCommerce arena, including Flipkart (part of Walmart, Inc.), MercadoLibre, and Rakuten. Despite a competitive offering, they have not yet entered the top ranks.

Marketplaces in China: Pinduoduo Grows Rapidly

On top of Taobao, Tmall, and JD.com, another marketplace called Pinduoduo has seen a rapid rise in popularity in China's eCommerce market. The tech giant achieved a remarkable annual growth rate of 24.6% in 2023, securing the number one position in China's ranking.

Exclusively serving the Greater China region, Pinduoduo’s main product category is Fashion, which accounts for over half of its global GMV of US$570 billion. The company also stands out for its innovative mobile-centric approach.

Moreover, it has launched a highly engaging shopping model customized to the social context of Chinese buyers, including community group buying.

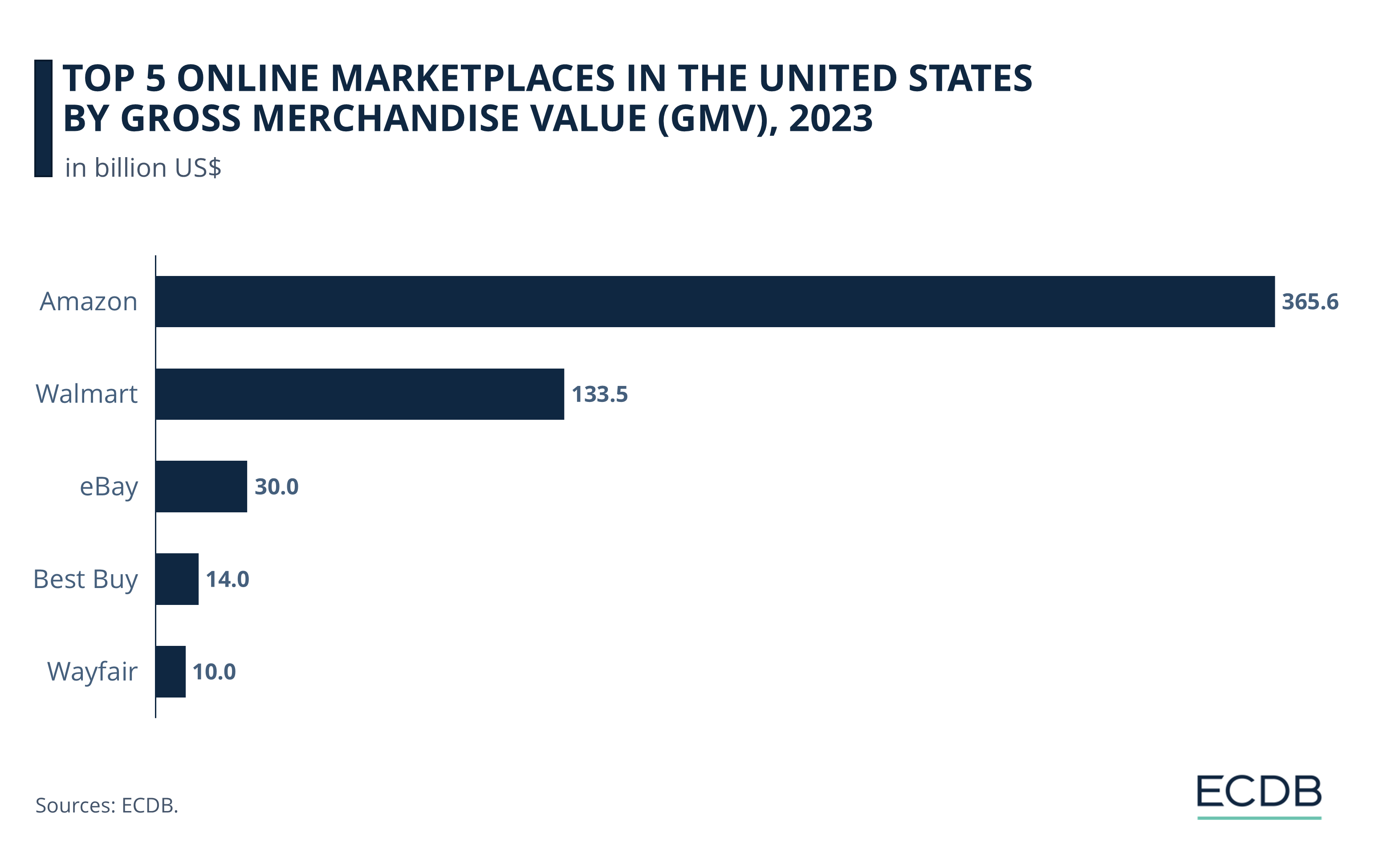

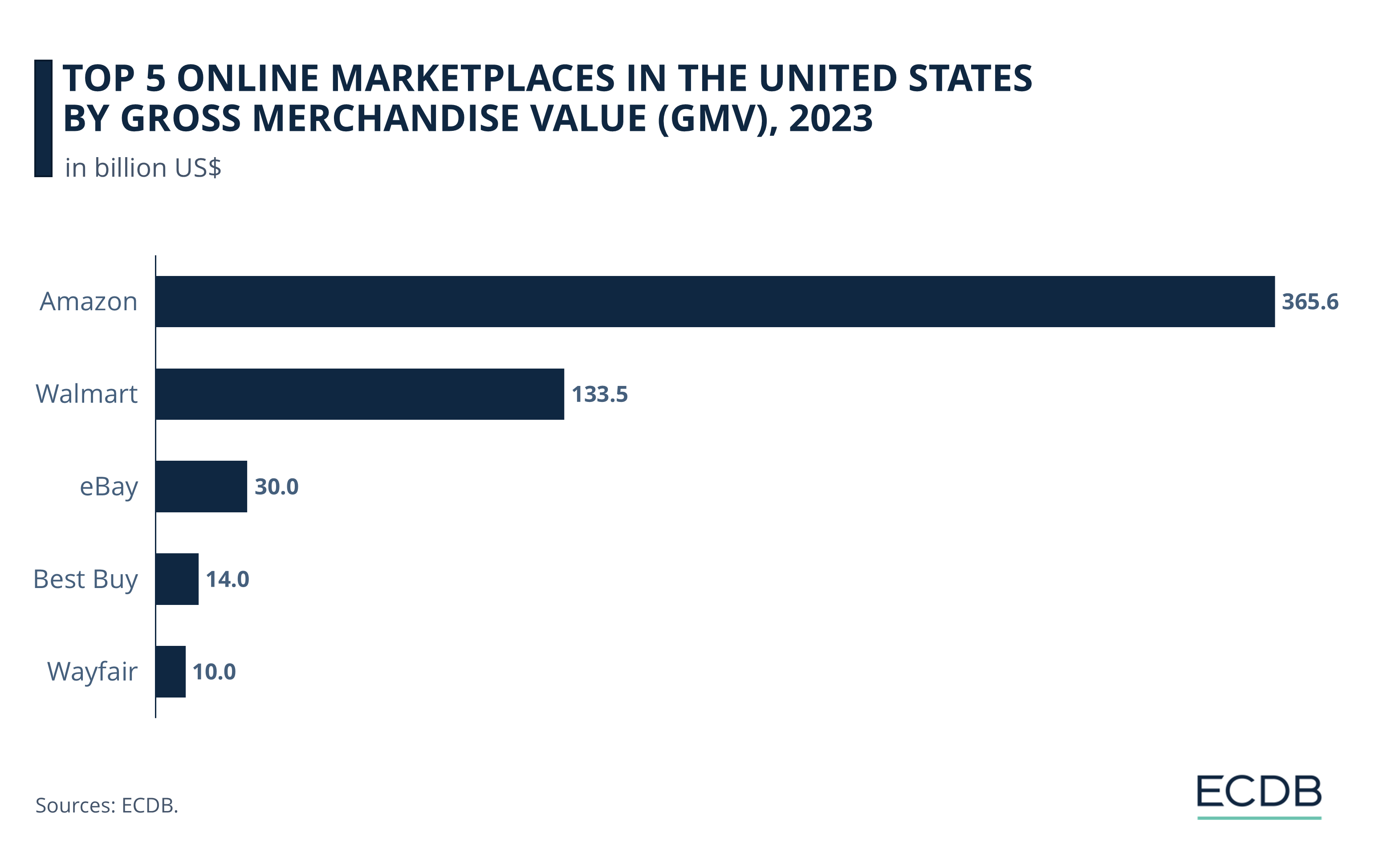

Amazon vs. Walmart: Competition in the U.S.

While Alibaba provides Amazon with stiff competition on the global stage and in China, within the United States, Amazon faces another worthy opponent:

In 2023, Amazon, Inc. and Walmart were the leading platforms in U.S. eCommerce, with revenues of US$365 billion and US$133 billion, respectively. Other key players in U.S. eCommerce include eBay, Best Buy and Wayfair.

Walmart has been seeing its market share declining in recent years due to rapidly changing market dynamics. Walmart's U.S. GMV of US$133 billion is significantly lower than Amazon's.

However, according to data from Fortune 500, Walmart is still king when it comes to total company revenue in 2023. This demonstrates the enduring strength of brick-and-mortar retail in the United States.

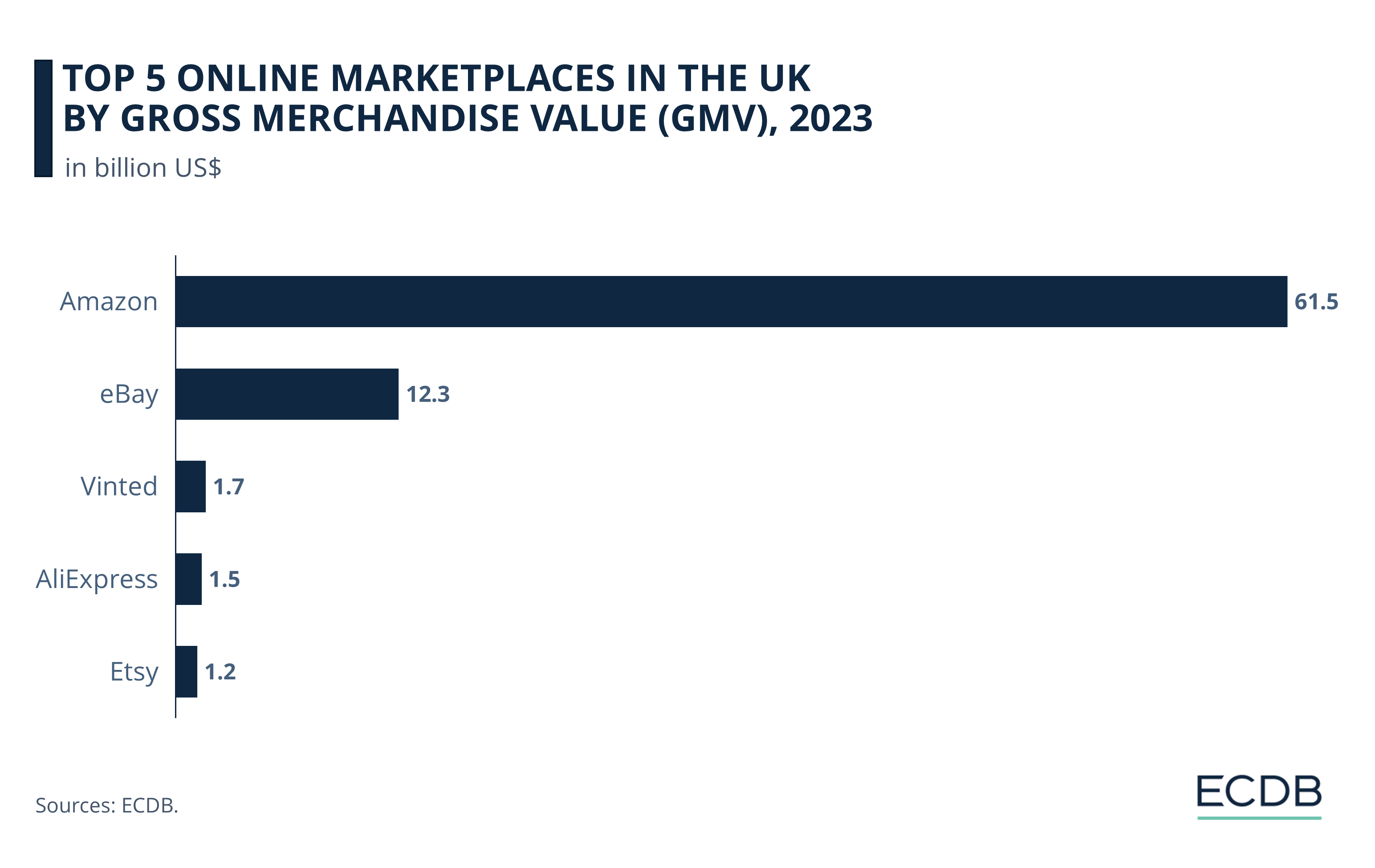

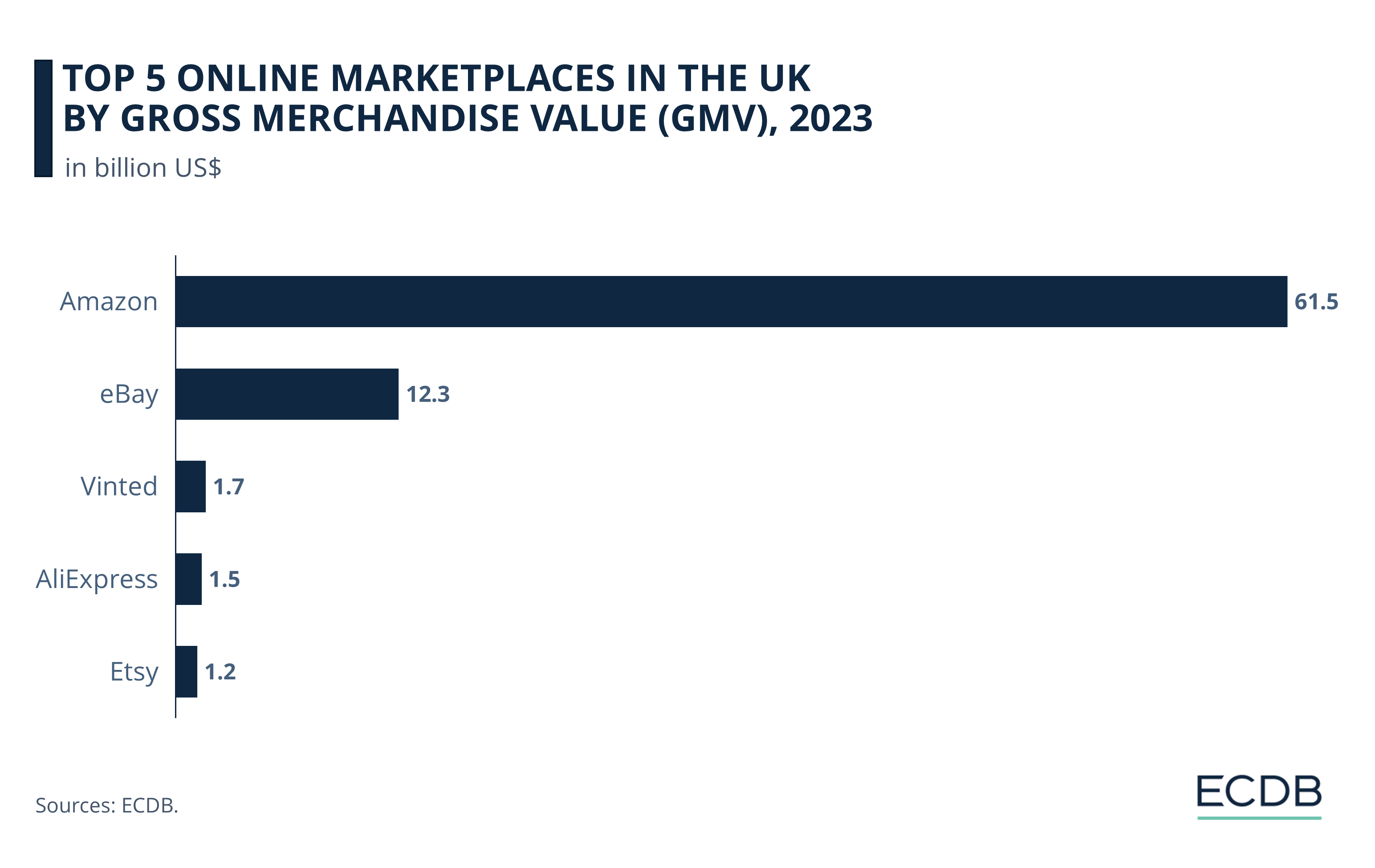

Top 5 Marketplaces in the UK

Looking at the top 5 online marketplaces in the UK by GMV in 2023, Amazon's outstanding position in the market is clear:

Amazon leads in terms of GMV (US$61.5 billion) in the UK, with an annual growth rate of 9% and a special focus on the category Hobby & Leisure (37%).

eBay follows with the second-highest GMV (US$12.3 billion), despite a decrease in growth of 1.5%. The U.S. enterprise's main category is Hobby & Leisure (26%).

Vinted holds the third position (US$1.7 billion) with a solid growth rate of 65% in 2023 and a focus on Fashion (84%).

AliExpress (US$1.5 billion) comes in fourth, with a yearly growth rate of 54%. Its strongest category is Fashion (31%).

Etsy ranks fifth (US$1.2 billion). The U.S. business sells Fashion most (42%) and recorded a decline in annual growth (-1.5%).

Amazon's dominance in the UK eCommerce market is largely due to its vast product selection and diverse services, including fast delivery and varied payment options, enhanced by AI. Competitors like eBay, Etsy, and Vinted struggle to keep pace, with some experiencing business declines from 2022 to 2023 due to macroeconomic factors and platform-specific issues.

eBay, despite being the second-largest marketplace, faces shrinking engagement and revenue post-pandemic, widening the gap with Amazon. The sustainability of eBay's position is now uncertain as Amazon continues to grow.

Top Amazon Competitors: Concluding Remarks

Amazon is a leader in eCommerce and is the marketplace of choice in key markets such as the United States and the United Kingdom. However, Alibaba, through its subsidiaries Taobao and Tmall, has emerged as a significant competitor to the U.S. company.

Nevertheless, Amazon continues to strengthen its position through a variety of strategies, including new services and advertising spending to reach new consumers and increase its online visibility. The marketplace leader continues to forge ahead, tapping into the rich potential of various markets and demonstrating its continued relevance in the eCommerce industry.