In recent years, Turkey as a country has gone through a lot. Political instability and economic crisis have made it difficult for people in the country to maintain a decent life.

Despite all this, the eCommerce market in Turkey is set to grow. With an average growth rate of around 10%, the market is anticipated to experience a healthy growth in the next couple of years.

But which online stores are leading this promising market? Based on our data, we answer this question below.

Top Online Stores in Turkey by Revenue

Alongside the familiar faces in the top 10, such as Amazon, Apple and MediaMarkt, three players are emerging at the forefront: Trendyol, Hepsiburada and Migros.

Let's dive deeper to understand what sets these platforms apart in Turkey's growing eCommerce scene.

1. Trendyol

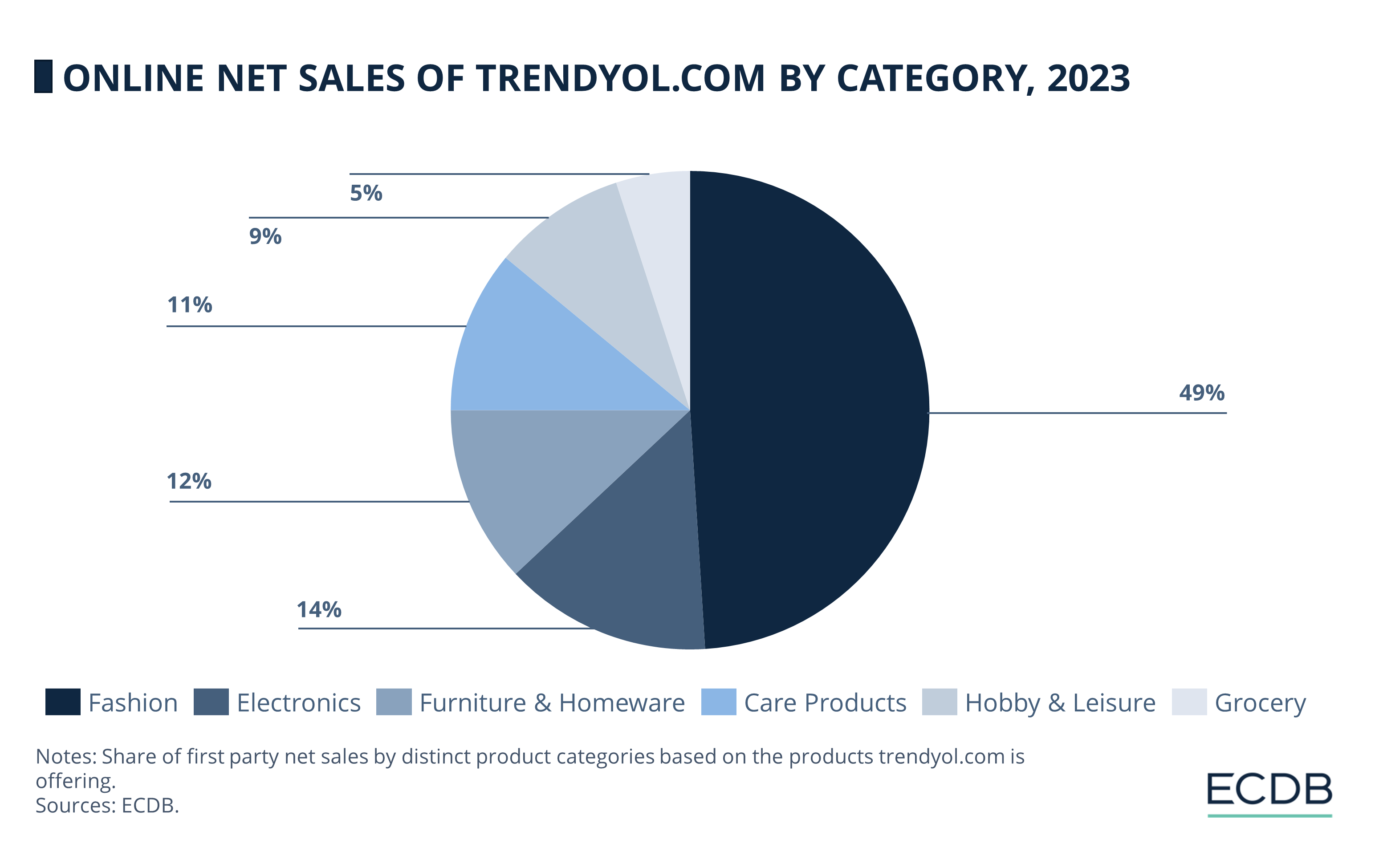

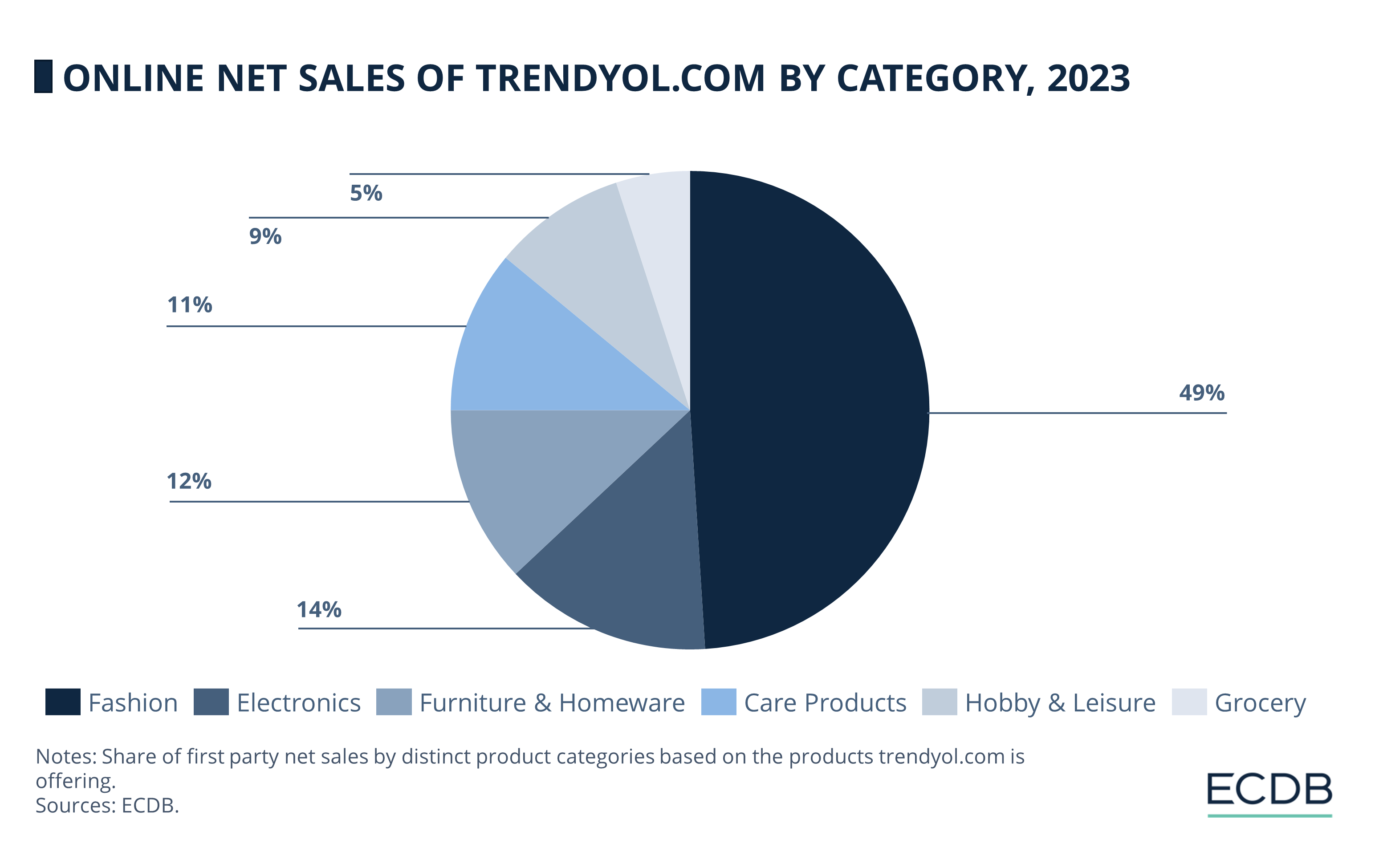

Trendyol.com stands, by far, as the leading player in the Turkish eCommerce market, generating US$4 billion in revenues last year. Primarily serving the domestic market, it's a diversified online store offering a range of products from Fashion to Electronics. In 2023, trendyol.com, holding the #1 position in Turkey's fashion market, accounted for almost half (45.7%) of eCommerce net sales in this category with US$2 billion.

In 2018, Alibaba Group secured a significant stake in Trendyol, offering technological aid and proficiency to the Turkish platform. Thanks to funding from Alibaba and other investors, Trendyol distinguished itself as the inaugural Turkish tech firm to achieve Decacorn status, a designation reserved for startups surpassing a valuation of US$10 billion.

The strategic partnership between Trendyol and Alibaba Group aims to boost Turkey's eExports. Trendyol is enhancing Turkish product visibility on Alibaba's platforms, investing in technology and logistics to enable Turkish SMEs (Small and Medium-sized Enterprises) to export their goods. This collaboration offers Trendyol technological insights from Alibaba, whose global network will foster Turkey's eCommerce growth and elevate its eExport levels.

2. Hepsiburada

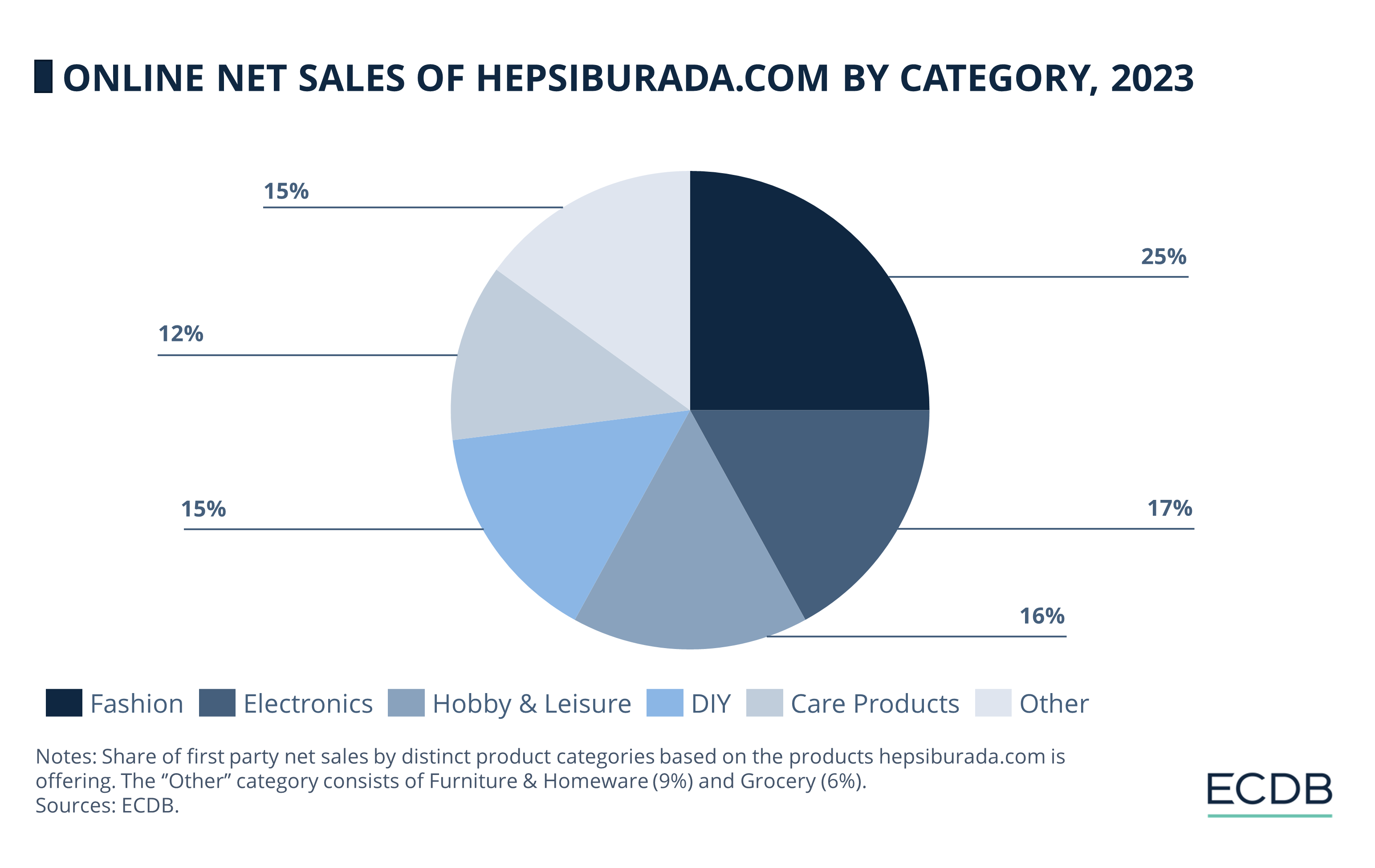

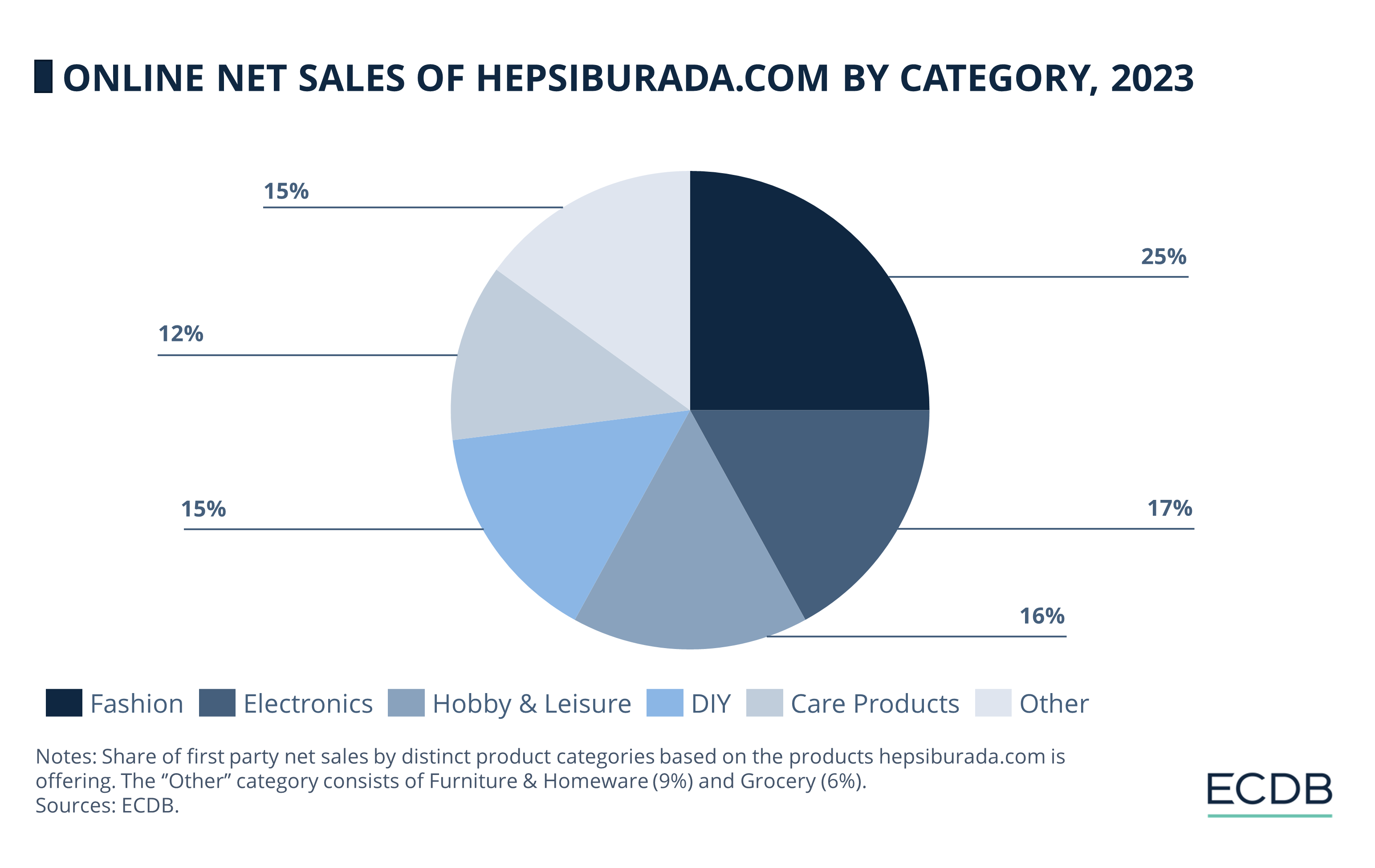

Hepsiburada.com, the second biggest online store in Turkey and the first Turkish company to be listed on the Nasdaq stock exchange, was launched in 1998 and primarily focuses on domestic sales. Generating its eCommerce net sales almost exclusively within the country, the platform offers a diverse product range including Fashion, Electronics and Hobby & Leisure.

Apart from being an online store, hepsiburada.com also hosts a marketplace, operates its own delivery system and provides door-to-door grocery delivery. In addition, the platform also offers travel booking, handling online payments, and managing deliveries from abroad.

As we covered before, under rising cost pressures, businesses are shifting from costly customer acquisition to encouraging existing customers to reorder. By utilizing strategies like tailored product ranges for specific target groups, they can stimulate customer loyalty and repeat purchases. Hepsiburada is following this trend, too.

Despite challenging economic circumstances in Turkey, Hepsiburada demonstrated resilience in the first quarter of 2024. The company reported a 42.5% annual increase in its gross merchandise value (GMV), reaching ₺36.3 billion (US$1.11 billion). Revenue surged by 45% from the previous year to ₺11.3 billion (US$346 million). The platform also saw a 21.7% year-on-year growth in order volumes, rising to 29 million orders, and an active customer base increase to 12 million.

3. Migros

The third biggest online store in Turkey, migros.com.tr, operates as an online store focused primarily on the Turkish market. Co-founded by Migros – Switzerland's largest retail company, supermarket chain and employer – Migros Turkey became independent of Migros Switzerland in 1975.

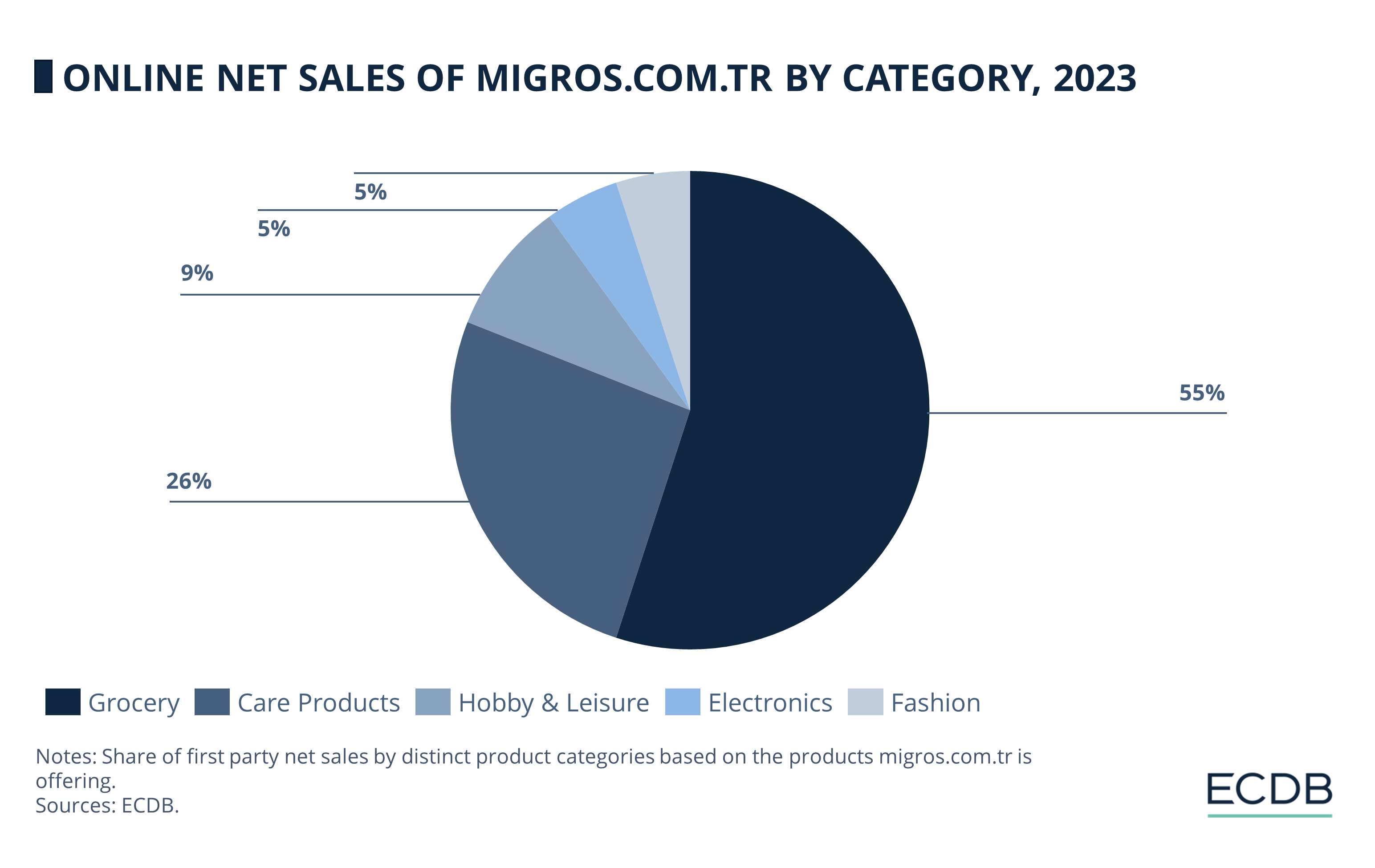

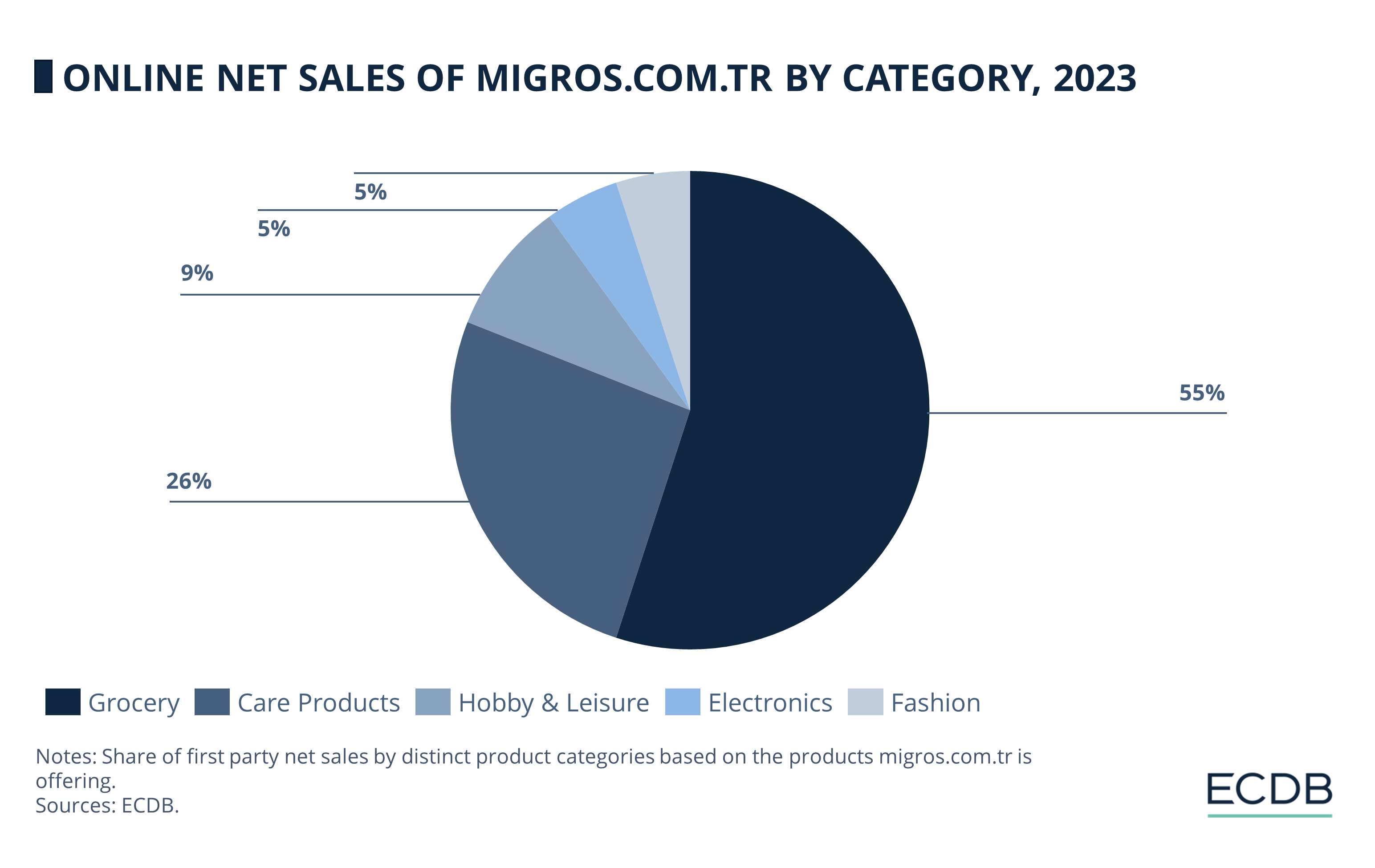

The online store's primary strength lies in the Grocery category, which contributes the largest share of its eCommerce net sales. In addition to this, the store also offers products in Care Products, Hobby & Leisure, Electronics, and Fashion categories.

Within the grocery market in Turkey, migros.com.tr has made a significant mark by at the top, with earnings of US$365 million in 2023, which amounts to 16.1% of the total eCommerce net sales in this category.

Migros plans to invest ₺6.5 billion (close to US$200 million) annually, doubling its market value to ₺120 billion (US$3.67 billion). CEO Özgür Tort highlights the company’s significant economic impact, with plans to triple online operations within 3 years and expand services like Migros Yemek. Migros is also investing in its delivery company Paket Taxi, launching the Mion cosmetics retailer chain, and installing electric charging stations through Migen. Additionally, Migros is shifting towards sustainable energy with a US$100 million investment in solar power.

Top Online Stores in Turkey: Final Thoughts

Turkey's eCommerce market is poised for robust growth, with revenues projected to reach US$38.39 billion by 2028. Key players like Trendyol, leveraging partnerships with giants like Alibaba, and Hepsiburada, demonstrating resilience and diverse offerings, are driving this expansion. Migros' significant investments in online operations and sustainable energy, too, underscore the sector's dynamic nature.

Despite economic challenges, the market's potential remains strong, fueled by increasing internet penetration and a young, tech-savvy population. However, investors should stay vigilant about inflation, market saturation, and regulatory changes, which could impact the sector's stability and growth.