Birkenstock's business model is that of a heritage brand with quality products and modern adaptation of retail channels. A closer look reveals: Birkenstock has altered its sales strategy in recent years. After pulling its products from Amazon, the brand decided to focus on direct-to-consumer sales outside of Europe. This shift, dubbed as Birkenstock’s "Louisvuittonization", is changing the “hippie” shoe brand as we know it.

How has Birkenstock’s marketing strategy shifted in recent years? How have its eCommerce sales developed, and what are the predictions for the coming years?

Birkenstock: “Louisvuittonization” Initiated the Strategic Shift

In 2016, Birkenstock had already announced the termination of its supply to the eCommerce giant Amazon in the United States. Shortly after, it withdrew from the European market, leaving retailers without its signature sandals as well.

This decision was due to Birkenstock's view that Amazon was not adequately addressing product counterfeiting and brand misuse. Despite Birkenstock's attempts to stop sales of their products on Amazon by filing six preliminary injunctions, these efforts proved to be unsuccessful. As of now, Birkenstock goods are still available on Amazon's marketplace through third-party sellers.

A decisive moment occurred 2023 when Birkenstock had its IPO on the U.S. stock exchange. In a disappointing turn, the German-headquartered company was valued lower than predictions – at $8.6 billion rather than the expected US$9.2 billion.

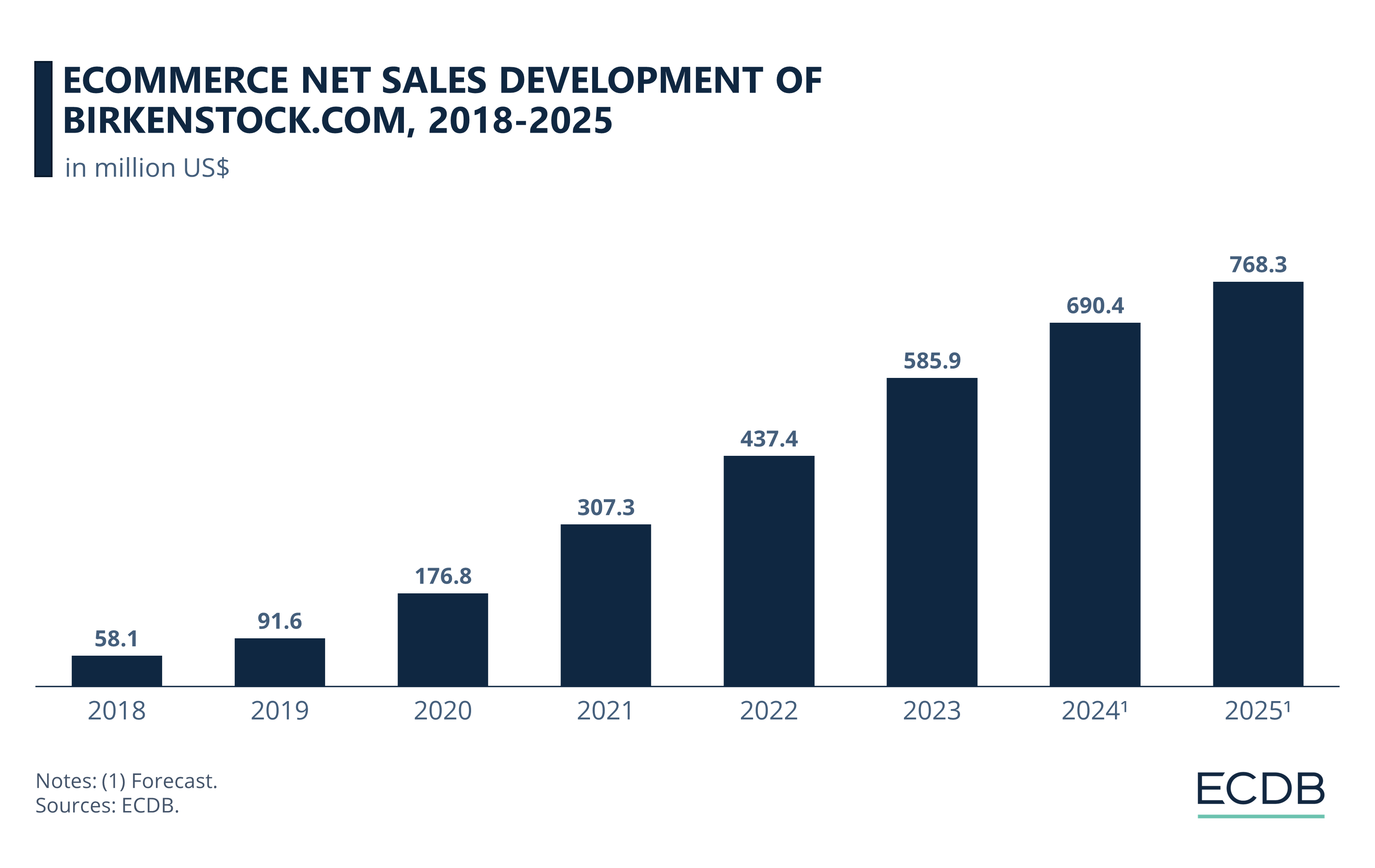

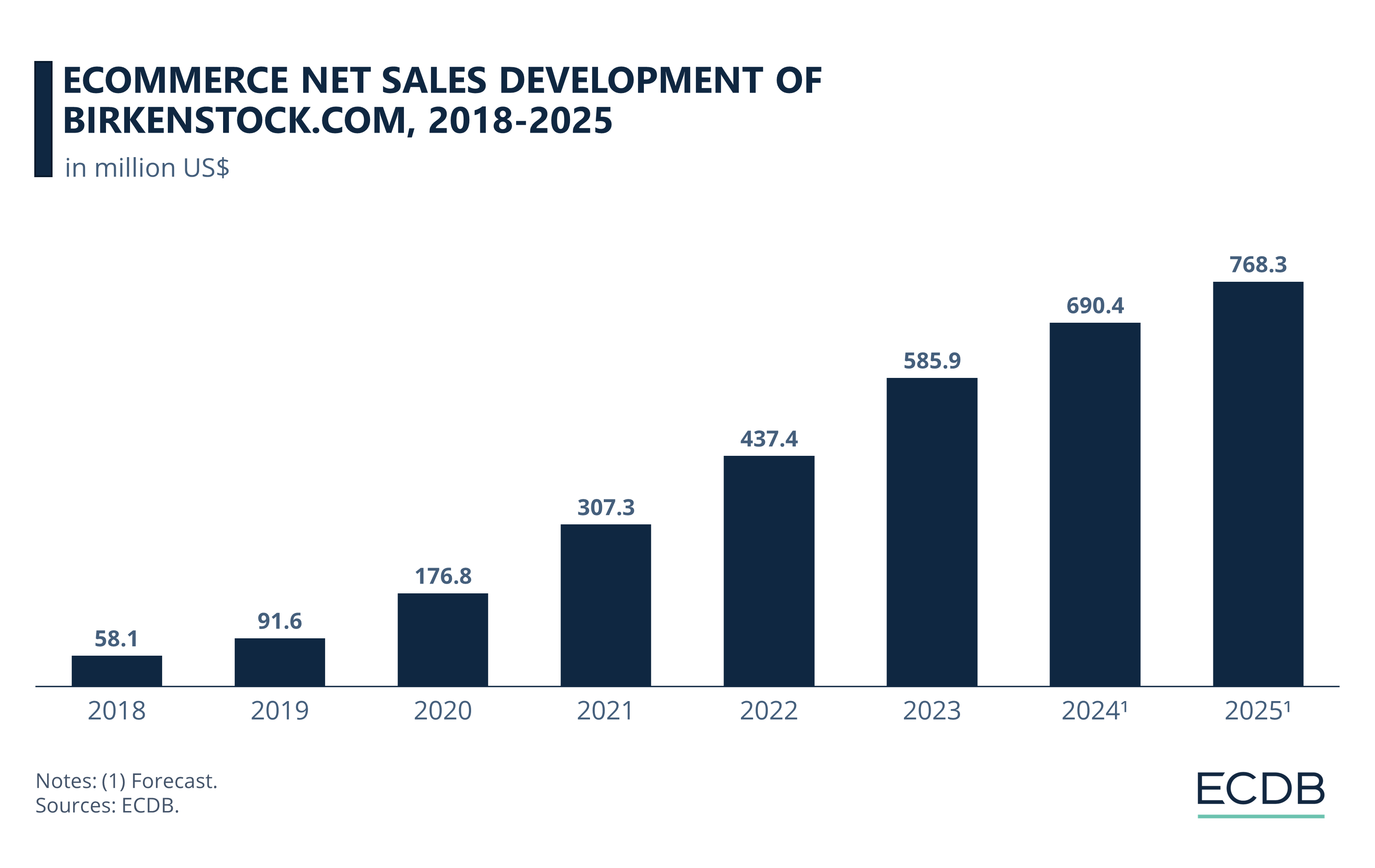

Net sales for Birkenstock.com grew enormously between 2018 and 2020 – going from US$58 million to US$176.8 million in a two-year period.

The growth was still strong in 2021, with sales climbing by a solid 74% and reaching US$307.3 million.

After the 2021 acquisition by LVMH, the adjustment period led to a slowdown. While net sales still increased in the next two years, the growth rate was comparatively modest.

With a yearly growth of 32%, revenues for Birkenstock’s online store hit US$585.9 million last year.

The online store’s net sales are expected to reach US$684 million in 2024 and cross US$763 million by 2025.

Birkenstock Marketing Strategy

In the years following, Birkenstock underwent substantial transformations. In 2021, Moët Hennessy - Louis Vuitton (LVMH) procured a 65% share in this well-established brand. Corresponding to their purchase of the luggage manufacturer Rimowa, the new stakeholder elected to cancel 50% of the contracts with retailers. In the case of Rimowa, all retail contracts were discontinued after just 15 months. This transformation has frequently been called as the "Louisvuittonization" of German makers of footwear and baggage.

Up until that point, Birkenstock mainly relied on traditional business-to-business (B2B) retail to sell its shoes. However, with the recent growth of online retail, birkenstock.com is now accessible in 21 countries and 17 languages. Furthermore, there are currently 46 physical stores in Europe and an additional 3 in the U.S.

Birkenstock, a heritage company founded in 1774, improved overall sales through its branded online store. The decision has led to visible positive results, with net sales rising to US$437.4 million by 2022. This represents a CAGR of 66% since 2018. While the pandemic period was characterized by high growth rates, the typical industry-wide decline in online net sales after stores reopened in 2022 did not affect Birkenstock as much. Instead, the shoemaker increased eCommerce net sales by 42.3% year-over-year.

LVMH acquired the company in 2021, through a backed private equity firm called L Catterton. The move elevated Birkenstock into the ranks of premium brands across all product lines, as the investment portfolio is dominated by luxury companies. In this context, Birkenstock's IPO can be seen as an effort to further solidify its position as an "ugly" luxury brand in the North American market.

Fight for the Sandal Market in the U.S.

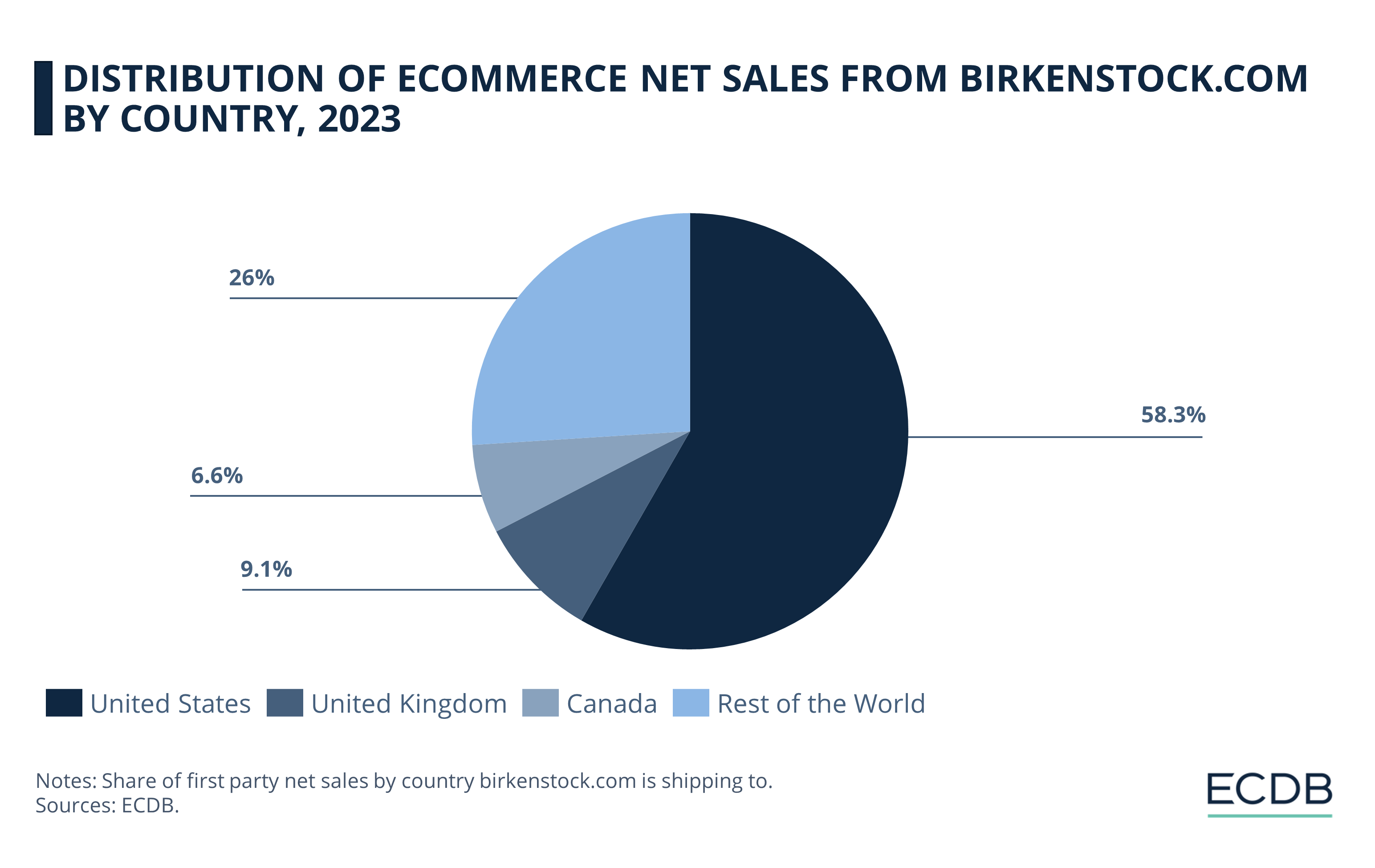

Birkenstock originated in Germany, but this is not its primary market. With the migration to North America in the 1970s, the brand's main markets also changed.

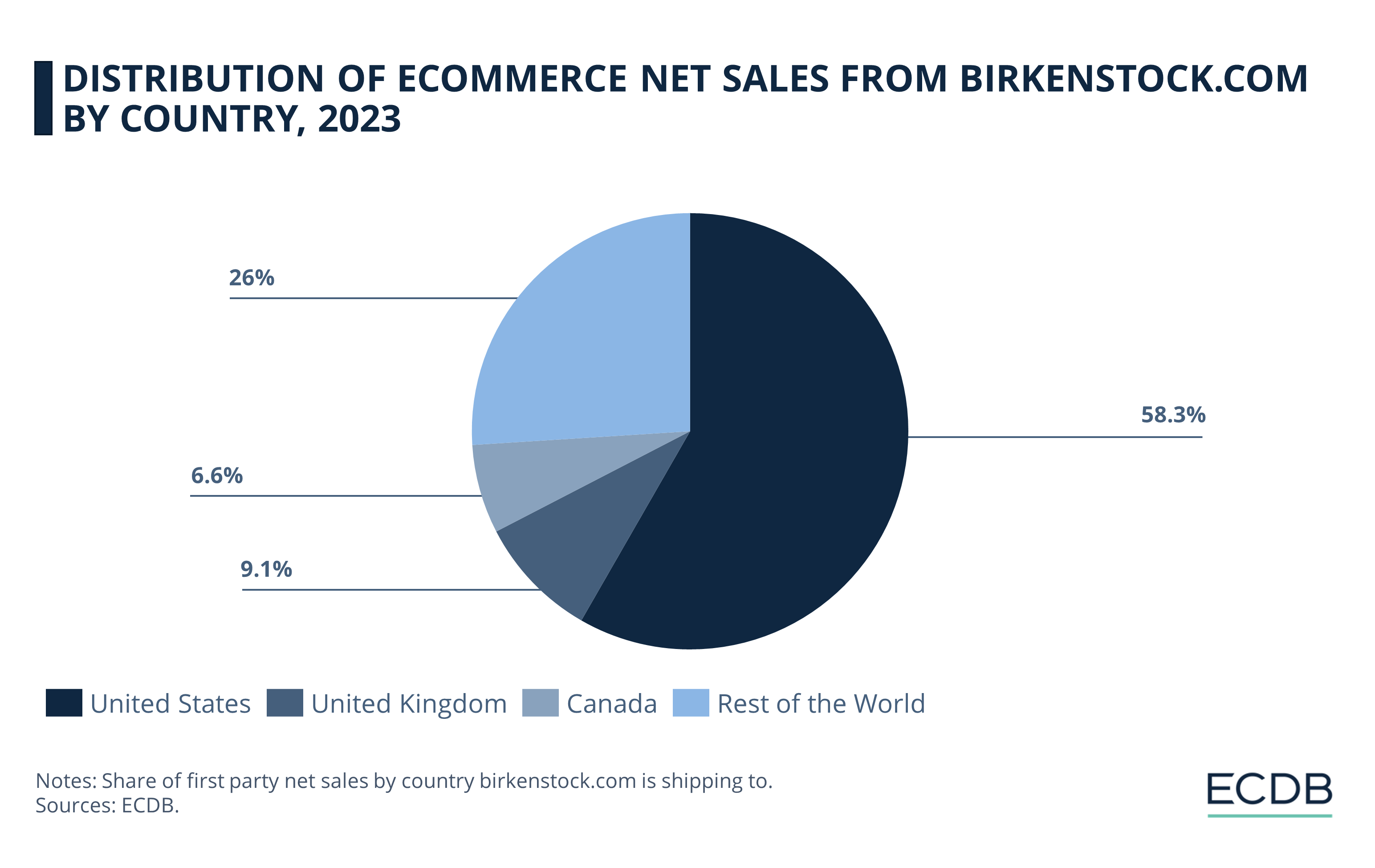

United States Make Up Largest Shares: The primary market for Birkenstock.com in terms of net sales is the U.S., which represents 58.3%.

UK and Canada Follow: The second largest market is the UK, accounting for 9.1%, while Canada replaced Birkenstock's home market Germany in 2023, reaching third place with 6.6%.

Europe and North America: The European region holds the majority of the top 15 markets, 12 of which are within Europe. However, including Canada, the North American market remains the most significant.

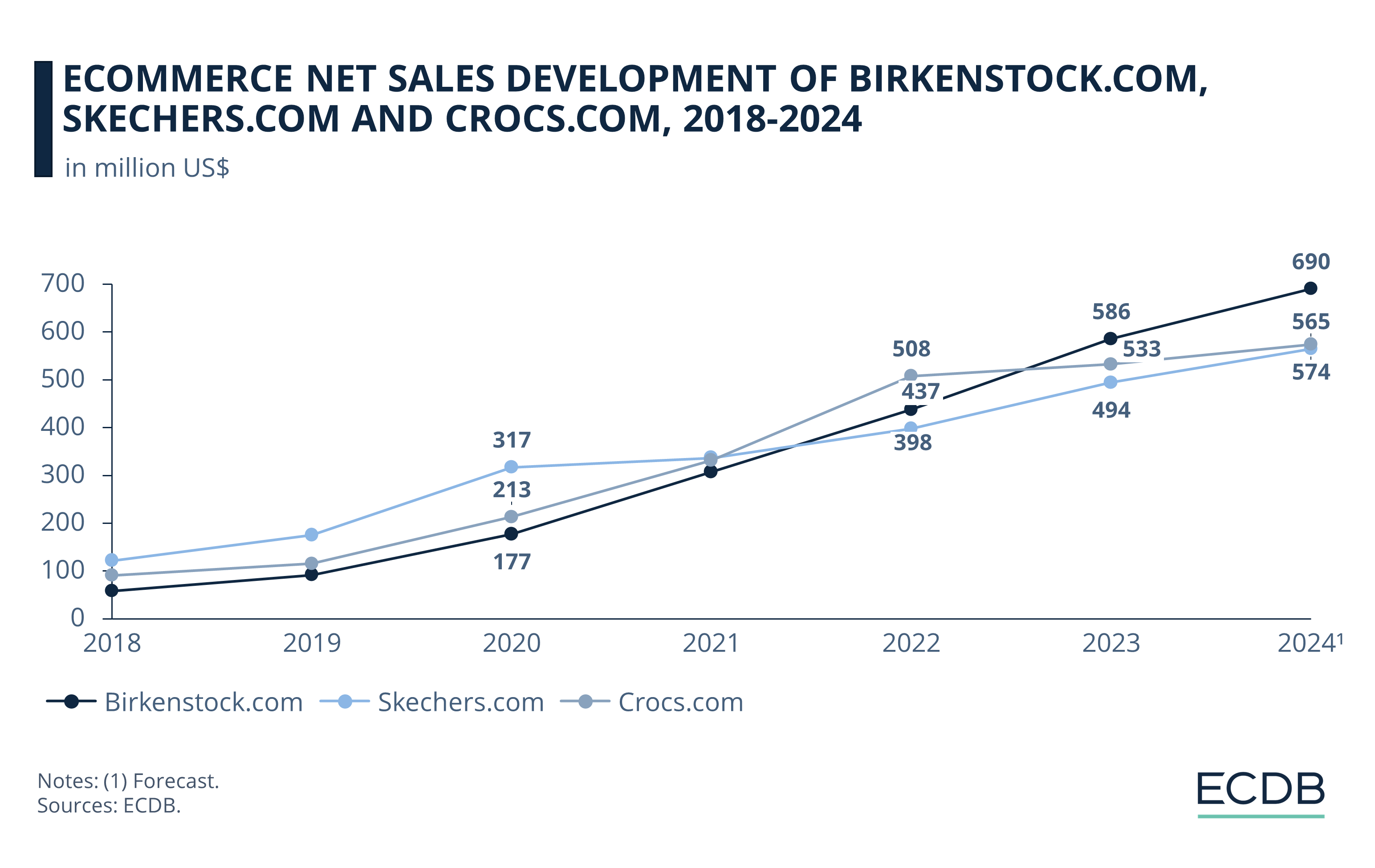

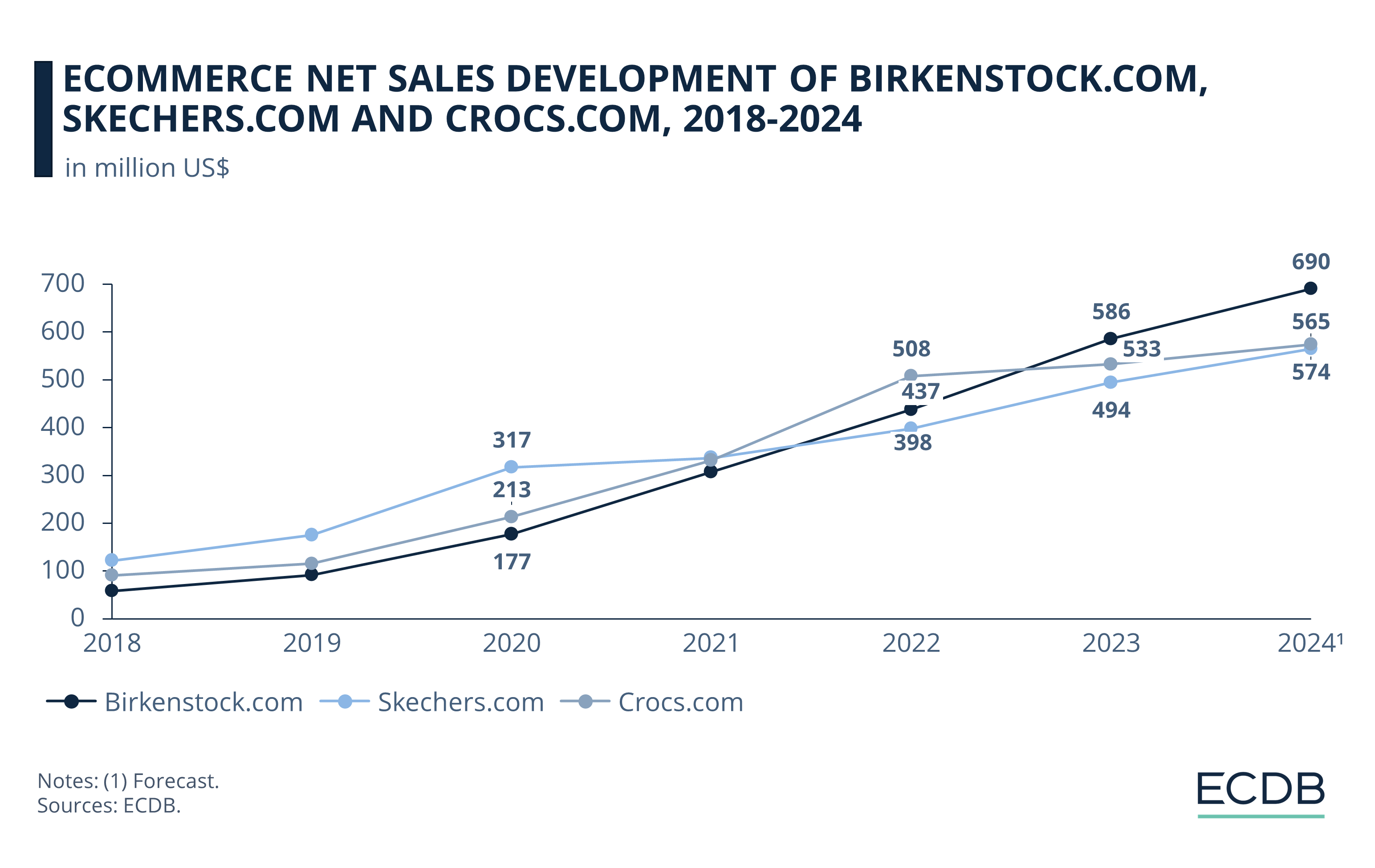

In its primary market, Birkenstock trails behind direct competitors. For instance, Skechers.com, a manufacturer of health-focused footwear, achieved a lower revenue of US$387 million in 2022 compared to Birkenstock but exclusively sells its products in the U.S. market. A similar situation applies to the footwear manufacturer Crocs.com, emerging as the top-selling sandal brand in the U.S. with revenues of US$508 million in 2022.

The figures suggest a positive prospect for Birkenstock's campaign. The anticipated growth rate for 2024 amounts to 17%, below Skechers' 21.6% but surpassing Crocs' mere 7.8%.

In concrete terms, this amounts to projected revenue of US$684 million globally for Birkenstock by 2024, while Skechers and Crocs only project figures for US$585 million and US$574 million, respectively.

Despite having a market valuation of US$7.55 billion, Birkenstock performs better than Crocs, which has a value of US$5.3 billion, but is only slightly surpassed by Skechers, valued at US$7.5 billion.

This shows that despite its weak debut on the stock market, Birkenstock can still have positive expectations for the profitable years to continue. The latest quarterly reports of international fashion groups such as LVMH, H&M and Nike show that this is not entirely a matter of course. Macroeconomic factors such as inflation and high interest rates also affect consumer spending.

Birkenstock's Online Business: Wrap-Up

Despite a challenging market situation, our ECDB analysis shows that there is plenty of potential, not only in fashion eCommerce, but also in the footwear eCommerce market. It is expected that eCommerce revenues of the global footwear market will reach US$381 billion in 2024. There is opportunity enough for Birkenstock to grab a share of revenues.

It remains to be seen whether Birkenstock.com's steady sales growth will have an impact on the share price in the future. Ironically, help could come from the shoe manufacturer's primary market: The sandals featured prominently in the blockbuster film "Barbie" and were seen as a symbol of real life. Let us see how real life continues for Birkenstock.com.