Every year, one night in February becomes something very special for American Football fans around the world: The Super Bowl. Not only is it a time to share a drink with friends and cheer on your favorite sports team, but it is also a commercial event for brands and consumers alike.

One of the ways people express their allegiance to their favorite sports team is by wearing team jerseys, apparel, accessories and buying collectibles. Fanatics is a household name in the distribution of licensed sports apparel and merchandise through multiple channels. Its thematic focus are all major sports disciplines popular in North America, particularly Football. As a result, Fanatics' most popular online stores are closely tied to the preferences of consumers in its primary market, the United States.

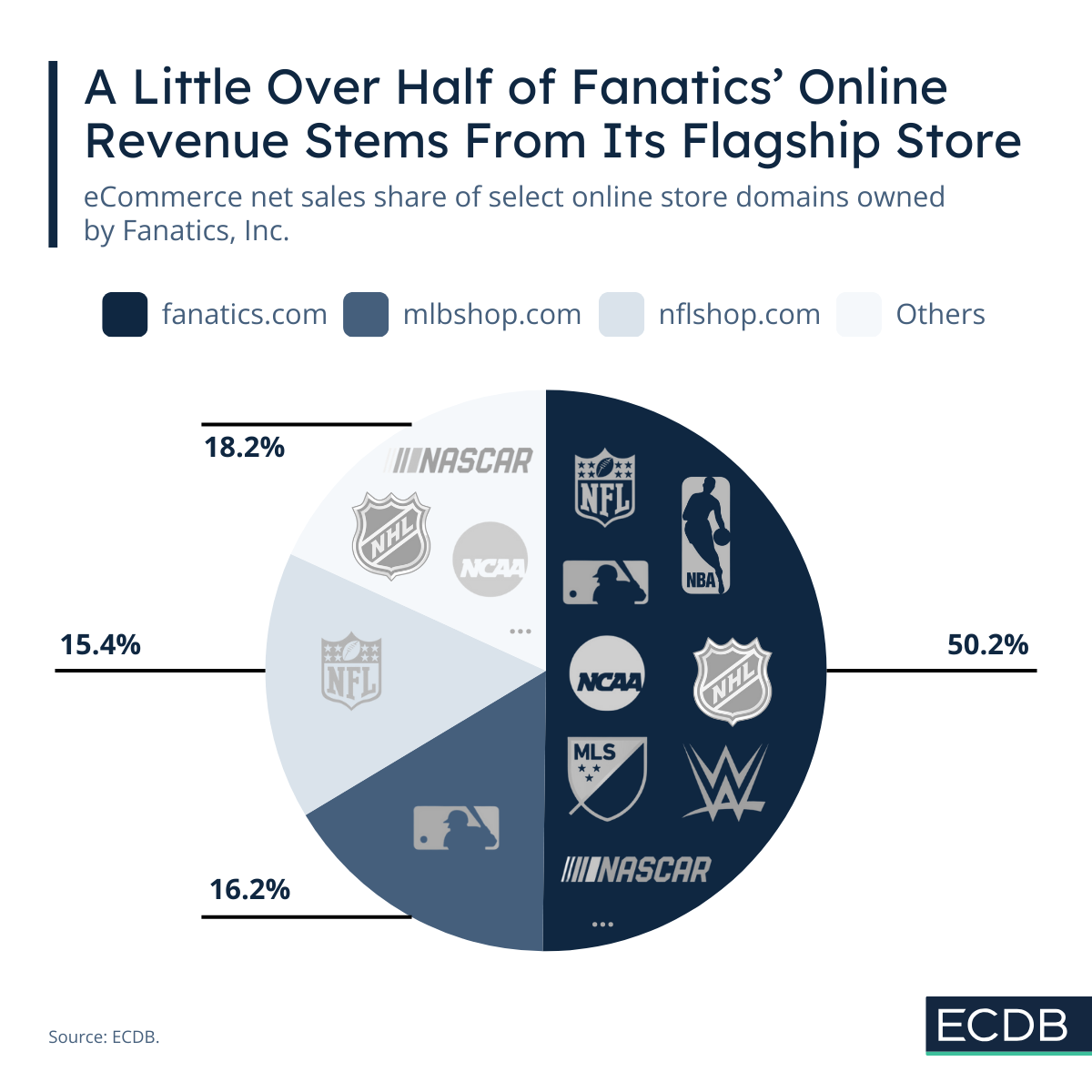

The Highest Grossing Domain of Fanatics Is Its Flagship Fanatics.com

As a U.S. digital sports company, Fanatics, Inc. focuses on the sports most popular in North America. In consequence, the most significant online stores for company eCommerce net sales are those with a thematic focus on one of these disciplines. In this case, it is the MLB and NFL, the respective baseball and football leagues.

Standing above the themed stores, however, is the flagship domain fanatics.com: More than half (50.2%) of the company’s eCommerce net sales are generated on this key domain. In 2024, eCommerce net sales on fanatics.com amounted to US$671 million. Its appeal extends beyond the prevalence of football and baseball enthusiasts in its core market, the U.S., where fanatics.com generates 96.6% of its revenue. The fanatics.com online store sells merchandise from all major types of sports: Basketball, College Athletics, Hockey, Soccer, Stock Car Racing, Martial Arts, and the major events associated with each.

As a result, fanatics.com reaches a broader audience than other subsidiaries. By comparison, mlbshop.com generated US$216.4 million in eCommerce net sales in 2024. Meanwhile, the third-largest Fanatics domain nflshop.com made US$206.2 million.

Mlbshop.com and Nflshop.com Contend for Second Place

The race for the number two domain is tight between mlbshop.com and nflshop.com. Both baseball and football belong to the most important sports disciplines in the U.S., which explains the success of the related online stores. In particular, sporting events such as the Super Bowl provide a repeated incentive to buy merchandise related to one's favorite team or player.

Looking at the annual net sales development of mlbshop.com and nflshop.com, the shifts and changes between the two are frequent: In 2023 alone, nflshop.com surpassed mlbshop.com by US$7.1 million, with net sales of US$210.2 million. In fact, every year since 2019, nflshop.com has been more successful than mlbshop.com. Only in 2024 did mlbshop.com take a narrow lead.

This confirms the outstanding significance of both baseball and football for sports enthusiasts in the market, and the immense potential to generate consistent revenue by satisfying the demand for proximity to one's favorite team or player.

Many Smaller Domains in the “Others” Category

The online retail domains grouped under the "Others" category in our infographic include many smaller stores with a narrower focus on less popular sports or a single team. Fanatics’ subsidiary fansedge.com, for instance, offers much of the same merchandise as its flagship fanatics.com, but with more of a focus on special editions and brand collaborations. The remaining online stores sell merchandise for college football (collegefootballstore.com), soccer (kitbag.com), hockey (nhl.com), stock car racing (nascar.com) and specific sports teams (mancity.com and chelseamegastore.com), bringing in revenue beyond once-a-year events such as the Super Bowl.