The world is changing, and so are our consumer habits. Where once the maxim was "the newer, the better," it is now common to buy used goods. In the case of electronics, refurbishers resell used electronics after overhauling them to ensure functionality.

In the German eCommerce market, retailers like Refurbed and Back Market are ascending the ranking of top Electronics eCommerce marketplaces. The trend towards environmental awareness is driving development, but who is more affected by it?

Refurbed and Back Market in the German Top 10 Electronics Marketplace Ranking

The German marketplace ranking for Electronics has Amazon in first place, followed by Media Markt and eBay. Down below, shortly ahead of the tenth position, Kaufland, Refurbed and Back Market have entered the ranking.

Their business concept is that Back Market and Refurbed buy used electronics from consumers and re-sell them after revamping the products. The approach has several advantages. These include more competitive pricing and environmental benefits, as used products require less energy to sell and generate less waste.

The success of Refurbed and Back Market in Germany shows that this approach is in tune with the times. It affects one cluster of retailers in particular.

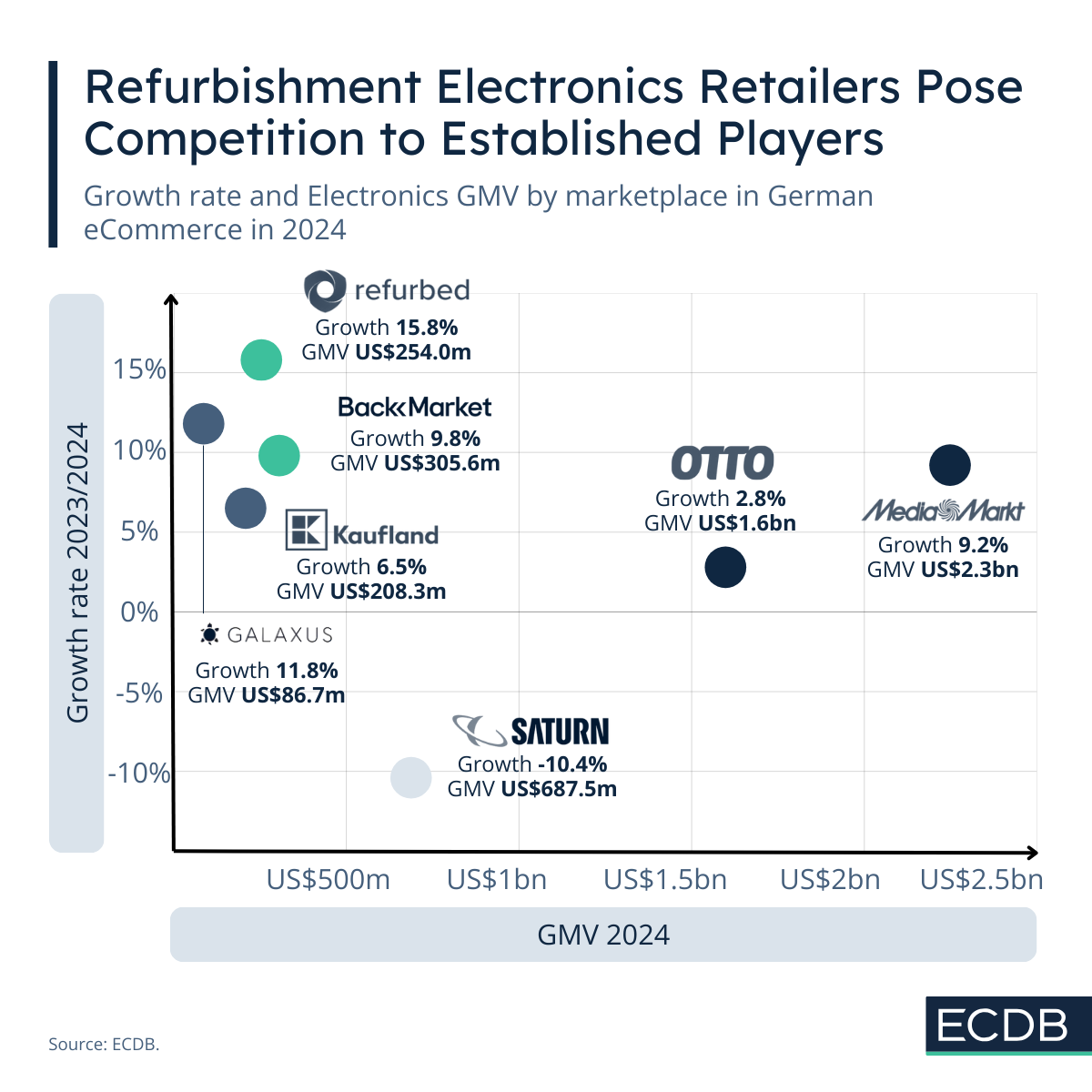

Refurbishers Are the Fiercest Competitors to Kaufland, Galaxus and Saturn

In the infographic on the top left, Kaufland and Galaxus are in a pile with Back Market and Refurbed. The two refurbishers even exceed the other two in terms of electronics GMV and growth rates. Refurbed is a little ahead of Back Market in terms of growth with 15.8% versus 9.8% respectively, but Back Market had the higher GMV in 2024 with US$305.6 million versus US$254.0 million of Refurbed.

Kaufland and Galaxus lag behind. Even though they have positive growth rates at lower GMVs, the largest piece of the pie goes to the biggest players (in this graphic Otto and Media Markt, but of course also Amazon, eBay and Apple). Lower ranking retailers have little to no chance to stand against the consumer preference for their favorite brand or a competitively priced refurbished item.

Saturn Headed South in Electronics Marketplace Ranking

Saturn, sister company to Media Markt as both are subsidiaries of Ceconomy AG, is the conglomerate’s problem child. It is positioned in the lower left corner in the infographic, with a not too shabby GMV of US$687.5 million in 2024 but a degrowth of -10.4%.

The issue with Saturn is not so much its competitive strategy as that its business model is basically identical to Media Markt, its sister company and closest competitor. For consumers, to choose either one is either a question of proximity, preference or simply going with the bigger one, which is Media Markt. But both are rarely used simultaneously, especially given the fact that the average consumer does not buy consumer electronics like smartphones or laptops several times a year.

What is common for both Media Markt and Saturn, however, is that they both offer their own version of a refurbishment service. Consumers can submit their used product and receive store credit in return, to use for their next purchase.

Back Market and Refurbed are still small, but they could become bigger and more relevant as awareness and popularity grows.