TikTok's April 5 ban deadline has passed, but the story doesn't end there: While the U.S. president's tariff policy continues to challenge the liberal world order, Trump saw an opportunity to gain ownership of TikTok Shop in exchange for lower tariffs on Chinese imports. Sounds unconventional? We bring light to darkness.

TikTok Shop as the Blueprint of Douyin Targeting the International Market

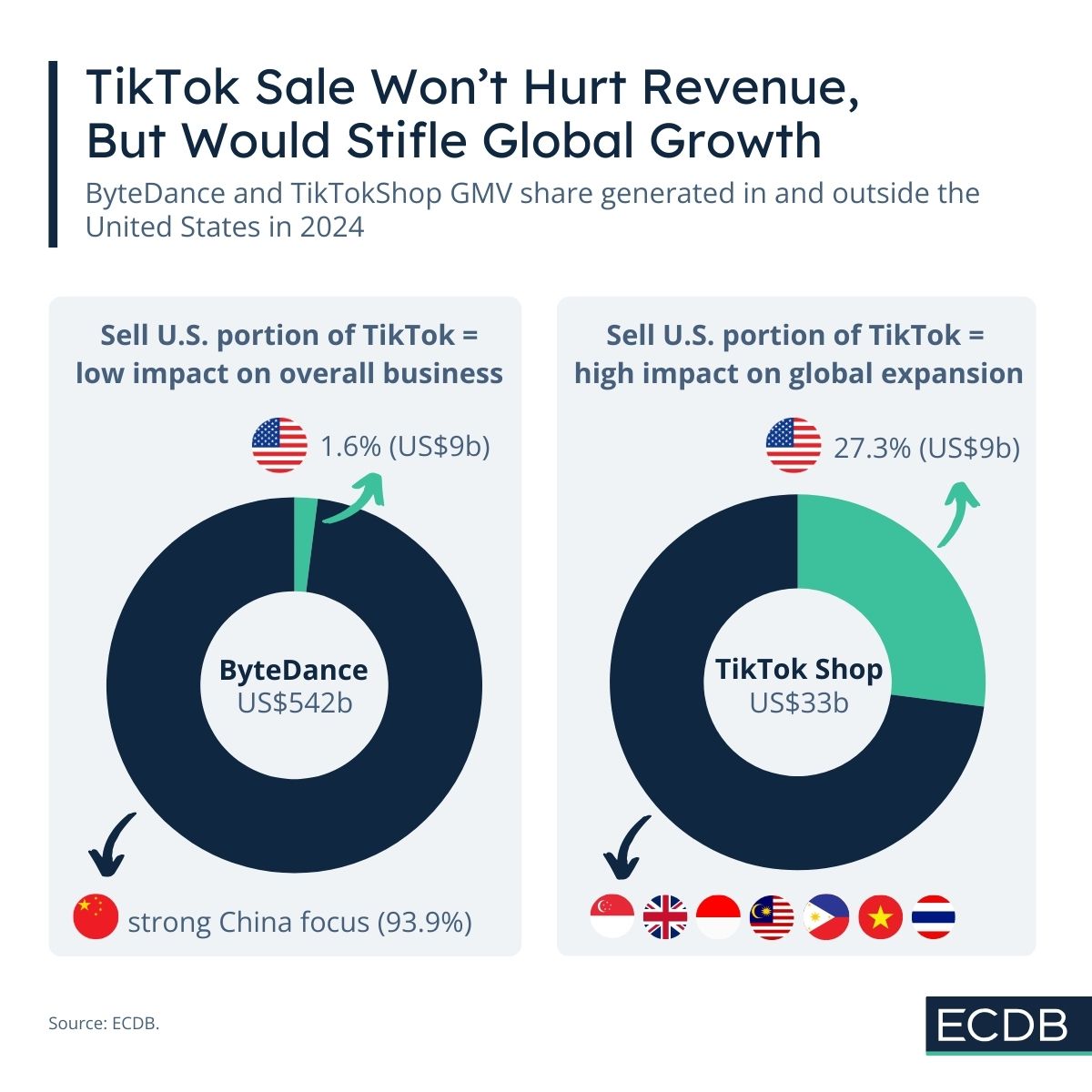

In 2024, the company ByteDance, Ltd. generated a GMV of US$542 billion. Over the past few years, the company has made huge strides and climbed into the top 4 eCommerce companies worldwide.

The largest portion – US$509 billion to be exact – was contributed by the social media platform Douyin, while US$33 billion came from the western version of the platform, TikTok Shop. In other words, ByteDance's GMV is composed by 6.1% of TikTok Shop's GMV and 93.9% of Douyin's GMV. Thus, Douyin is the main driver of the company's success.

While Douyin was exclusively built for the Chinese eCommerce and social commerce market, TikTok is a kind of blueprint of Douyin built for a public outside of China. And the business strategy works: Billions of people around the world use TikTok, but the marketplace feature TikTok Shop remains far from Douyins’ numbers – what's the reason?

TikTok Once Again in the Center of Discussion – A Battle Beyond Business Goals

Issue number one since TikTok Shop first launched in the Indo-Pacific region has been privacy and cybersecurity concerns. The platform keeps failing, be it in Indonesia and the Philippines, or more recently in Europe, where the Irish Data Protection Commission (Irish DPC) imposed a privacy fine. Especially in the context of its expansion in Europe, such fines are poisonous to TikTok Shop's success on the continent.

Moreover, with the new presidency of Donald Trump and the ongoing tariff conflicts of the U.S. with everyone else, ideas of selling TikTok to a Western company or even the United States itself stand in the room. The latter was a proposal by President Trump in exchange for presumably lower tariffs for China.

What Would a Sale of TikTok Mean?

First and foremost, selling TikTok would mean losing US$9 billion (1.6%) of ByteDance's GMV generated in the United States. This may not seem like much, but considering that this US$9 billion represents 27.3% of TikTok Shops' GMV, it means a larger loss of one-quarter GMV. Plus, the U.S. is the most important country market for the marketplace.

Meanwhile, such a development could have an equally strong impact on future expansion in Europe. The marketplace would have to invest more in newly entered markets such as Spain and Ireland to offset the loss. At the same time, it could make it more difficult to enter new Western markets, and those countries may prefer to have the business under their control rather than under ByteDance's.

In addition, TikTok, and especially its marketplace, offers potential for the future, as the number of possible users for the TikTok store is much higher than the more successful Douyin platform. And those who are interested know it, which is why even influencers like MrBeast or the owner of OnlyFans are interested.

In general, having the TikTok app and store in the hands of someone who is seen as friendly to the U.S. could greatly contribute to its success. It would make it much easier to expand into other Western countries, and the data issue could improve in favor of those states. Could TikTok Shop soon say "Go once, go twice, go three times, sold"?