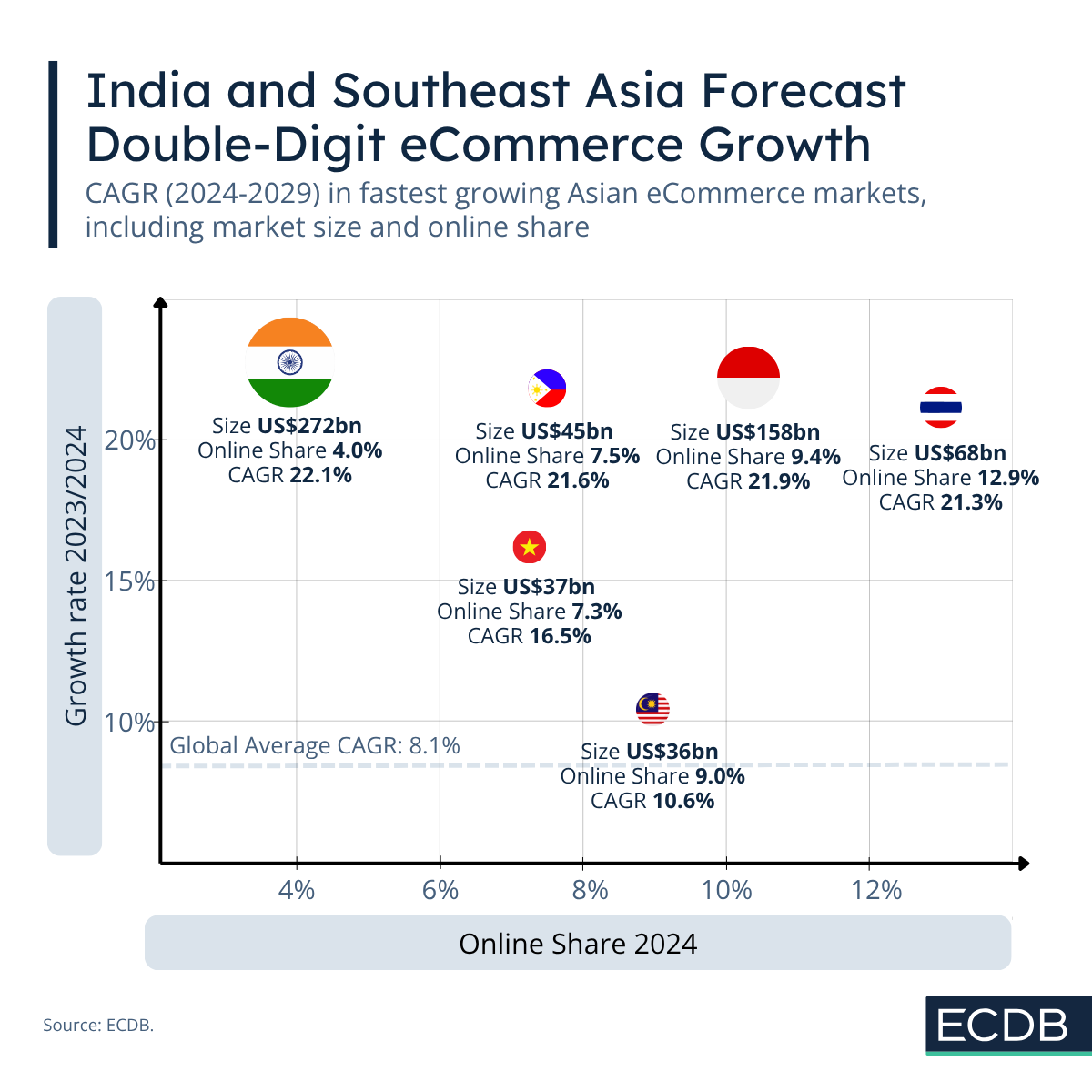

The Asian continent has the highest potential for global eCommerce, with many markets exceeding the world average CAGR (2024-2029) of 8.1%. Apart from the smaller, well-established markets, Asia has a remarkable number of countries with growth trajectories worth discussing.

Market size does of course contribute to higher growth, as smaller markets are more likely to grow faster because less revenue is needed to achieve significant percentage increases. Apart from that statistical reality, however, there are many more factors to consider.

India, Indonesia, the Philippines and Thailand Have a CAGR (2024-2029) Over 20%

For the analysis, we picked a threshold above US$10 billion in annual market revenue to ensure a minimum level of relevance. The top markets with a CAGR (2024-2029) of at least 10% reveal a group of highly thriving eCommerce regions.

At the top ranges of expected CAGR (2024-2029) development are India (22.1%), Indonesia (21.9%), the Philippines (21.6%) and Thailand (21.3%). These countries exceed the world average of 8.1% and vary in size and reasons for growth.

Following a little further behind but still significantly ahead of the world average are Vietnam (CAGR of 16.5%) and Malaysia (10.6%). As two smaller markets with a low online share, they do not belong to the top tier of high-potential markets, yet they are still noteworthy.

Southeast Asian Region Leads in Growth Through China’s Influence and Shopee

Five of the six fastest-growing eCommerce markets in Asia are in the Southeast Asian region. Southeast Asia (SEA) is of remarkable significance to eCommerce development. This is also evident in the dominant platforms in the respective online markets, which overlap.

Two aspects stand out in that regard: China’s influence is undeniable, as large part of the top eCommerce players in SEA are operated by Chinese companies. They include Lazada (powered by Alibaba), TikTok Shop (operated by ByteDance), Taobao and Tmall (two platforms by Alibaba).

Contrasting this is Shopee, an eCommerce platform headquartered in Singapore, although its shares are internationally distributed. Shopee ranks as the largest marketplace in all of the SEA markets, and its influence is growing. Shopee is usually followed by Lazada, its closest competitor owned by Alibaba.

The online shares of these markets are mostly between 7.0% and 10.0%, with Thailand the only exception of a relatively high share of 12.9%. Its positioning at the right-end side of the illustration highlights Thailand as a market to look out for in the coming years of eCommerce development.

India Falls Out of the Line: Highest CAGR and Alternative to Current Chinese Rule

India is simultaneously the market with the highest CAGR and the only one outside of Southeast Asia depicted as a growth market. Its status as the most populous country, with a young, tech-savvy consumer base, and a still-low online share, makes India attractive to eCommerce companies looking to expand.

Two of the leading U.S. players already control 83% of the top 10 marketplace’s revenues. Apart from that, India has a variety of domestic companies that play an important role in the market, backed by government policy.

Overall, however, the market is expected to see annual revenue increases of around 17% in a few years, with a current rate of 20.4%. Additionally, India's proximity to eCommerce leader China makes it attractive to foreign investors looking for alternatives to China's growing dominance in Asian eCommerce.