Article in a Nutshell:

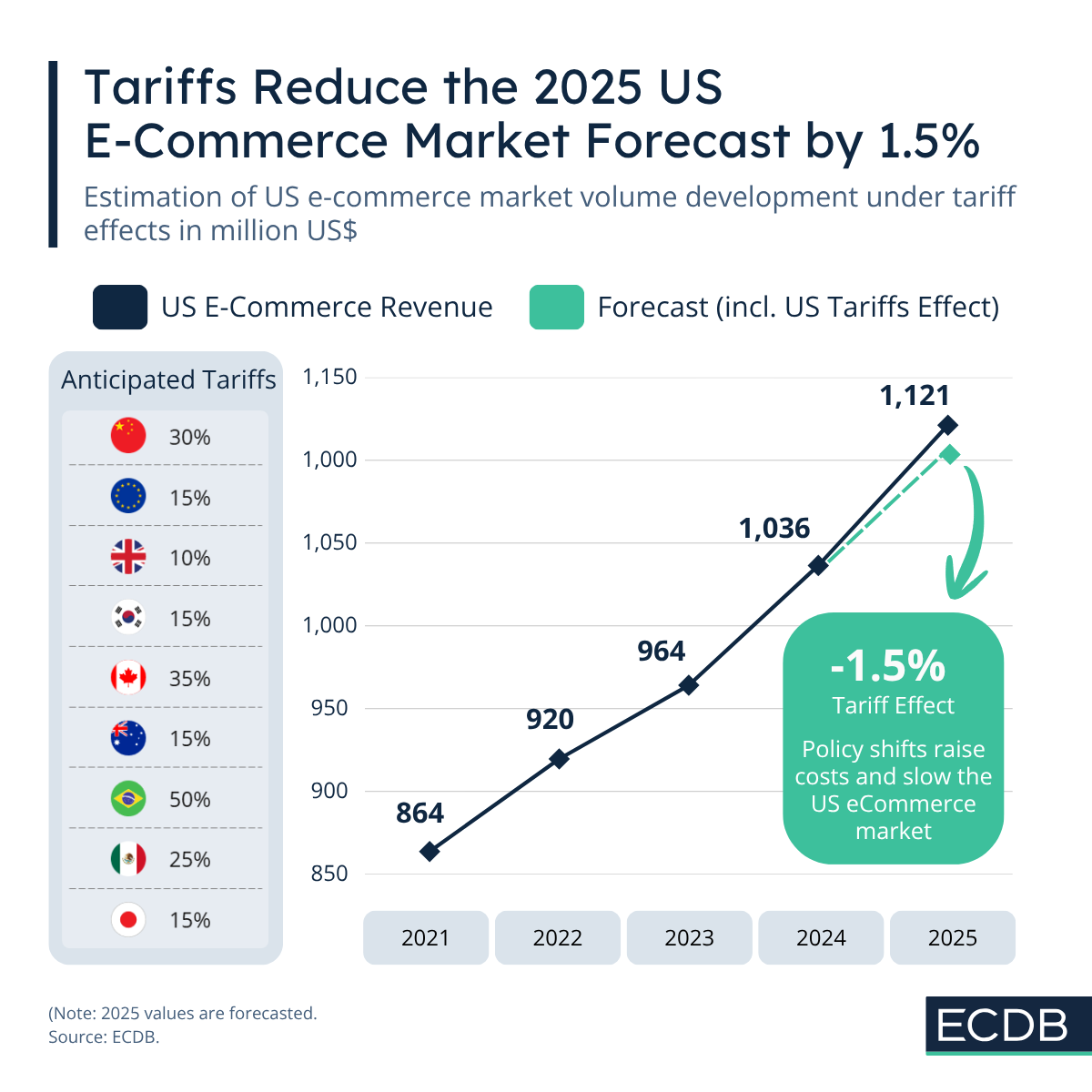

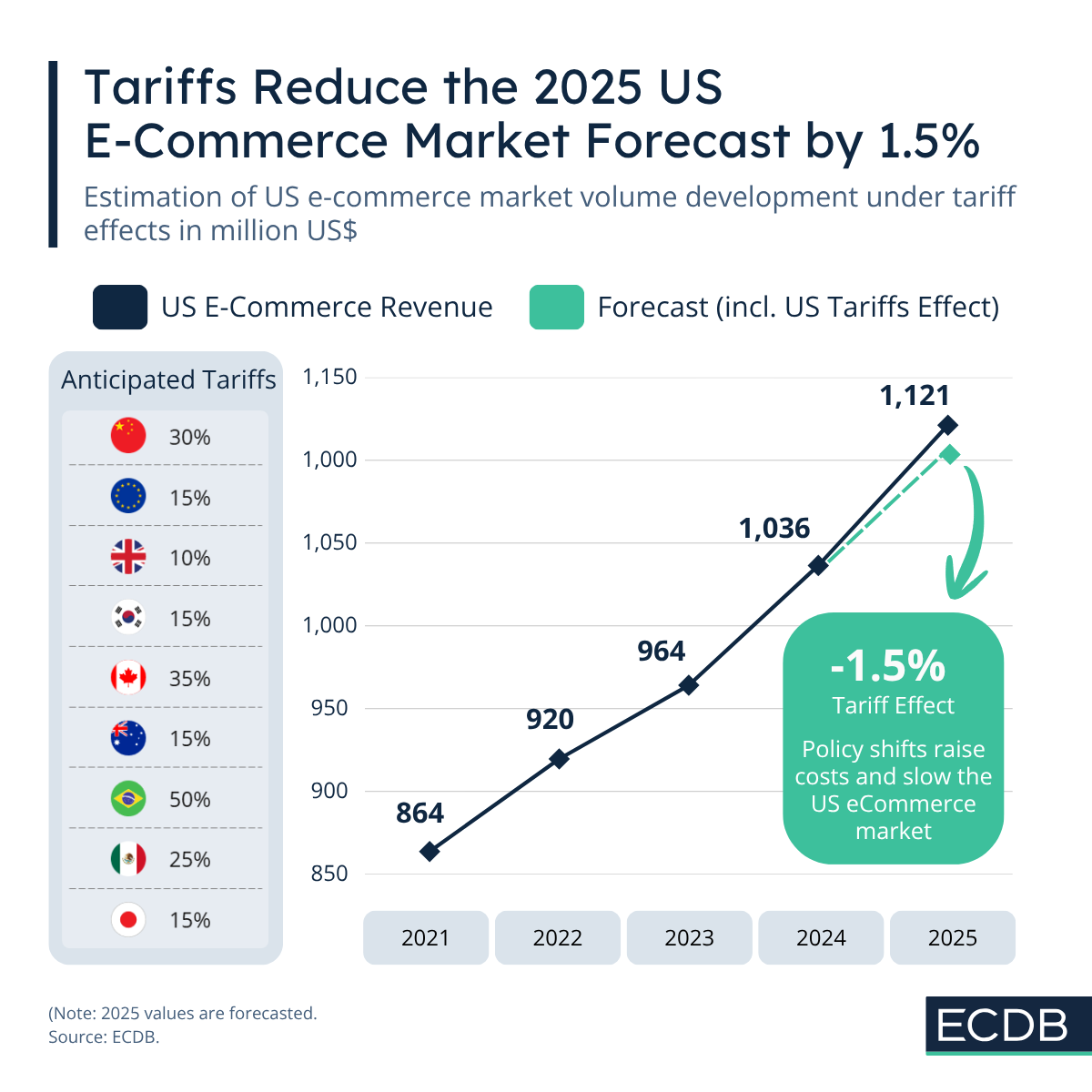

Tariffs reduce the 2025 US e-commerce outlook by 1.5%.

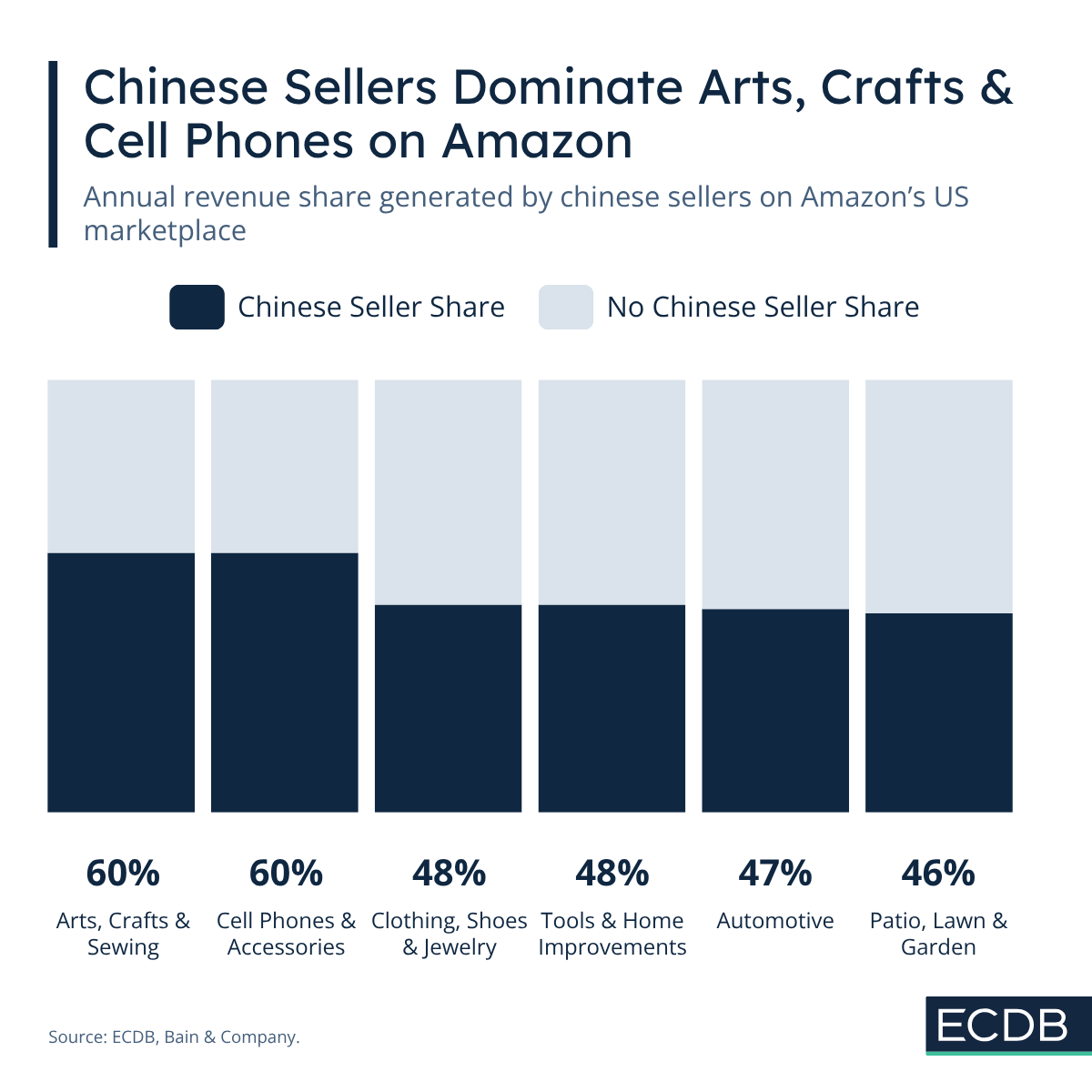

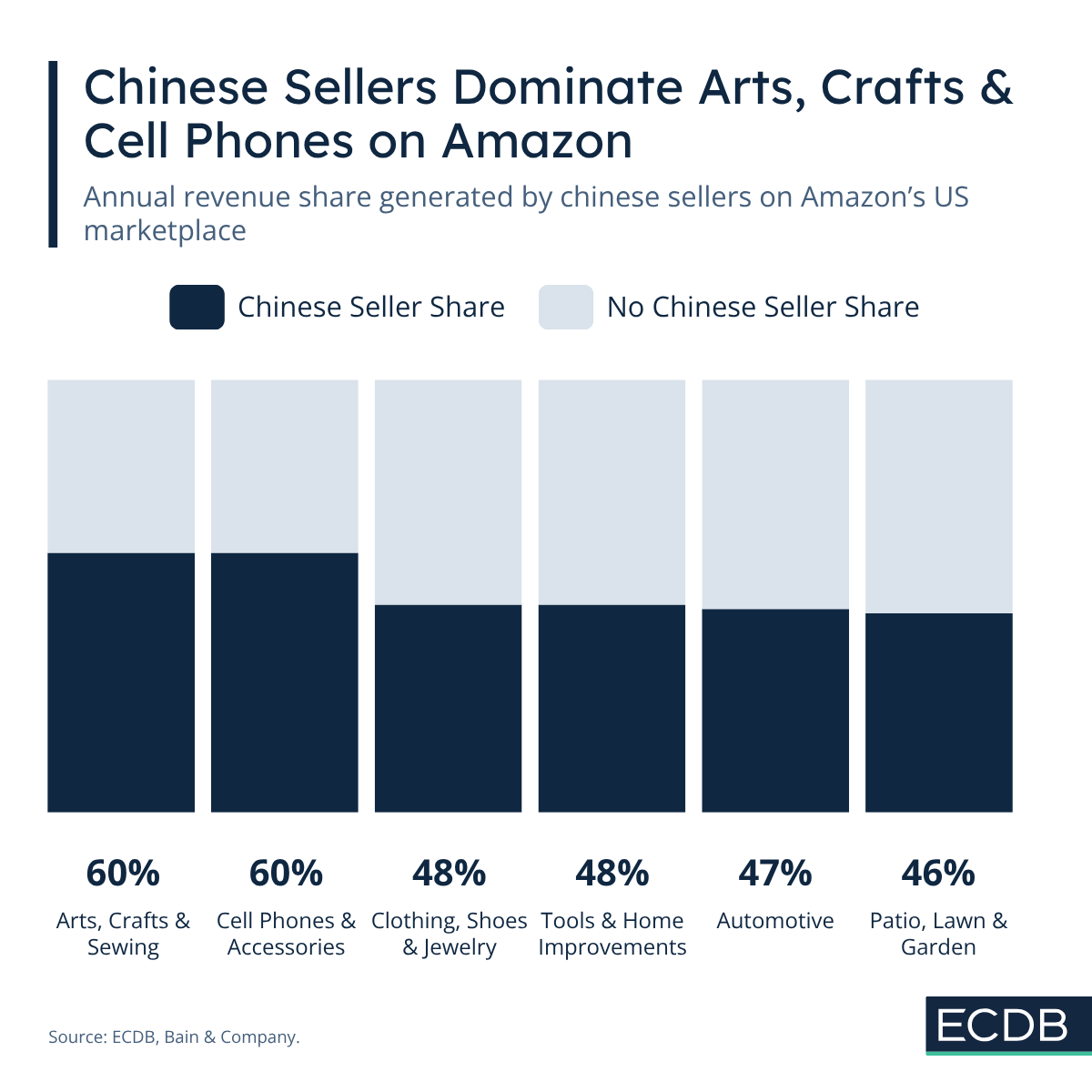

Chinese sellers command 50–60% share in several major Amazon categories.

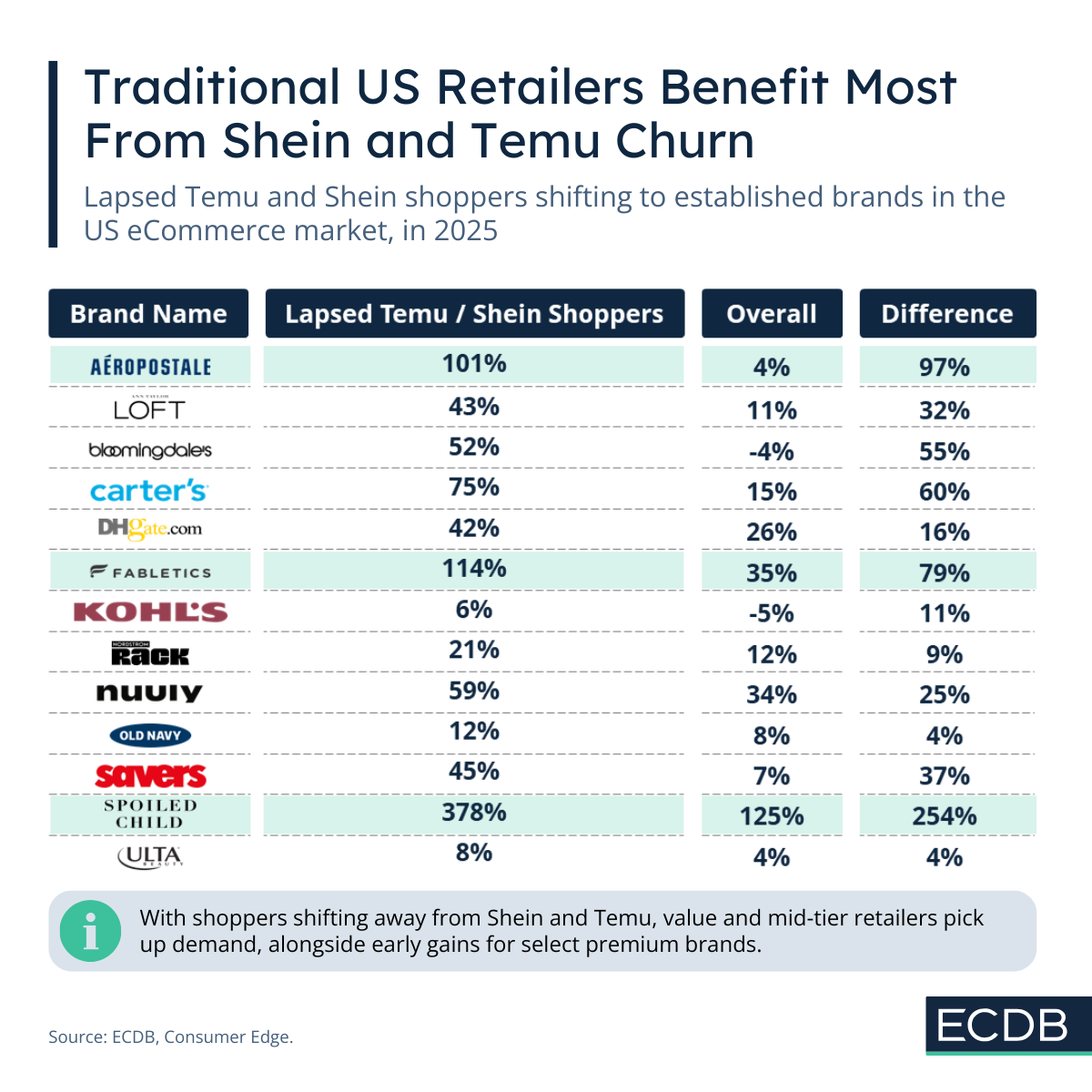

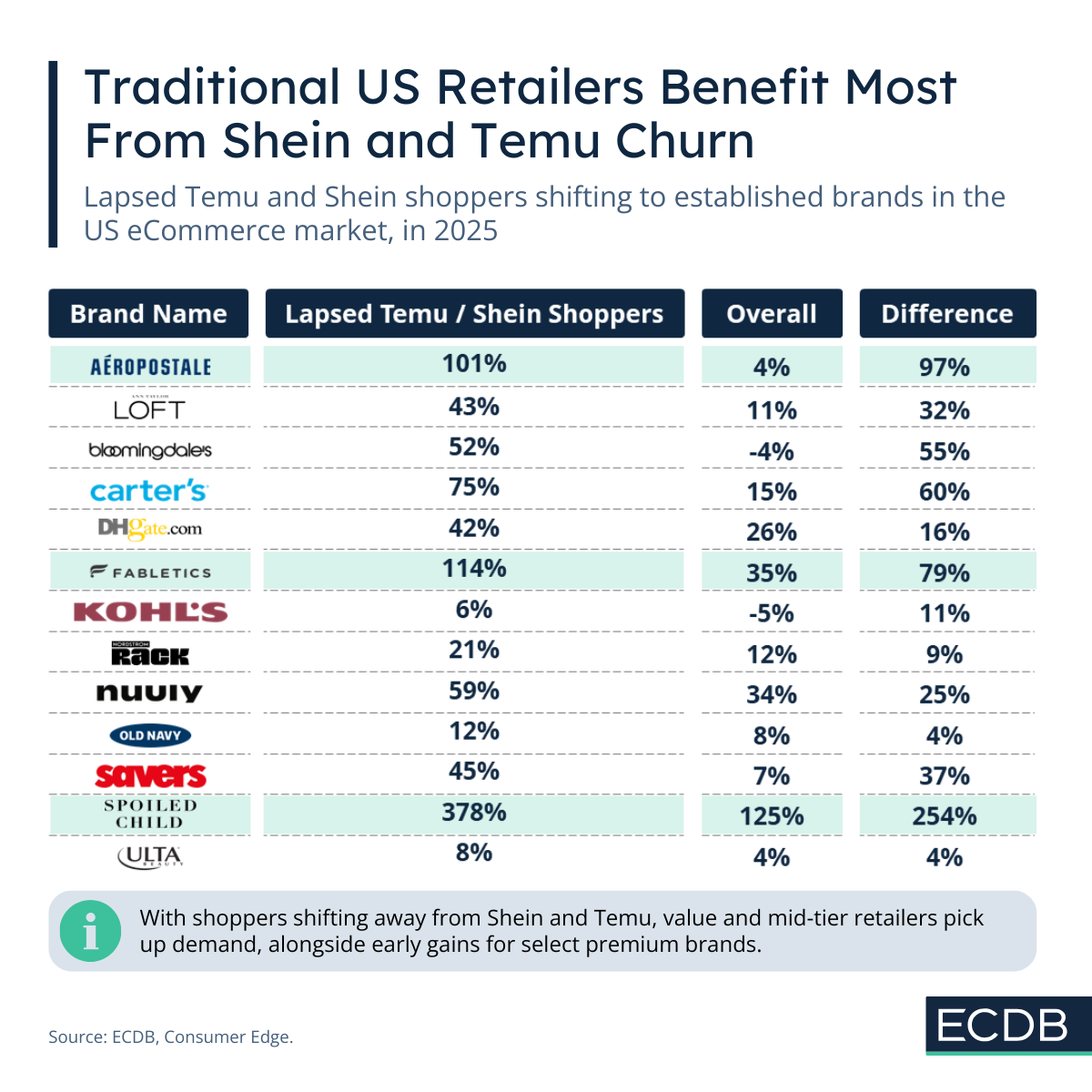

Lapsed Temu and Shein shoppers are increasingly shifting to traditional US retailers.

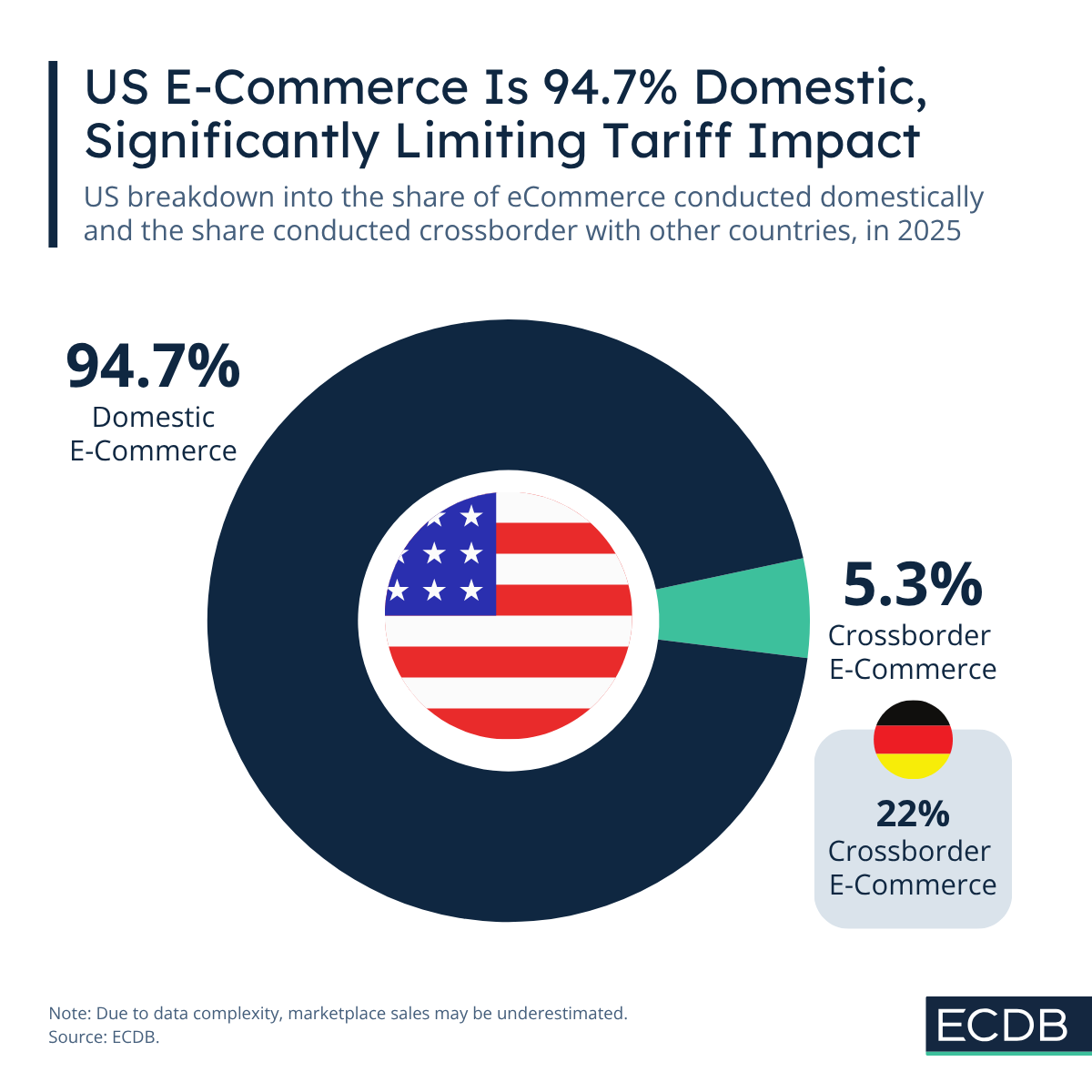

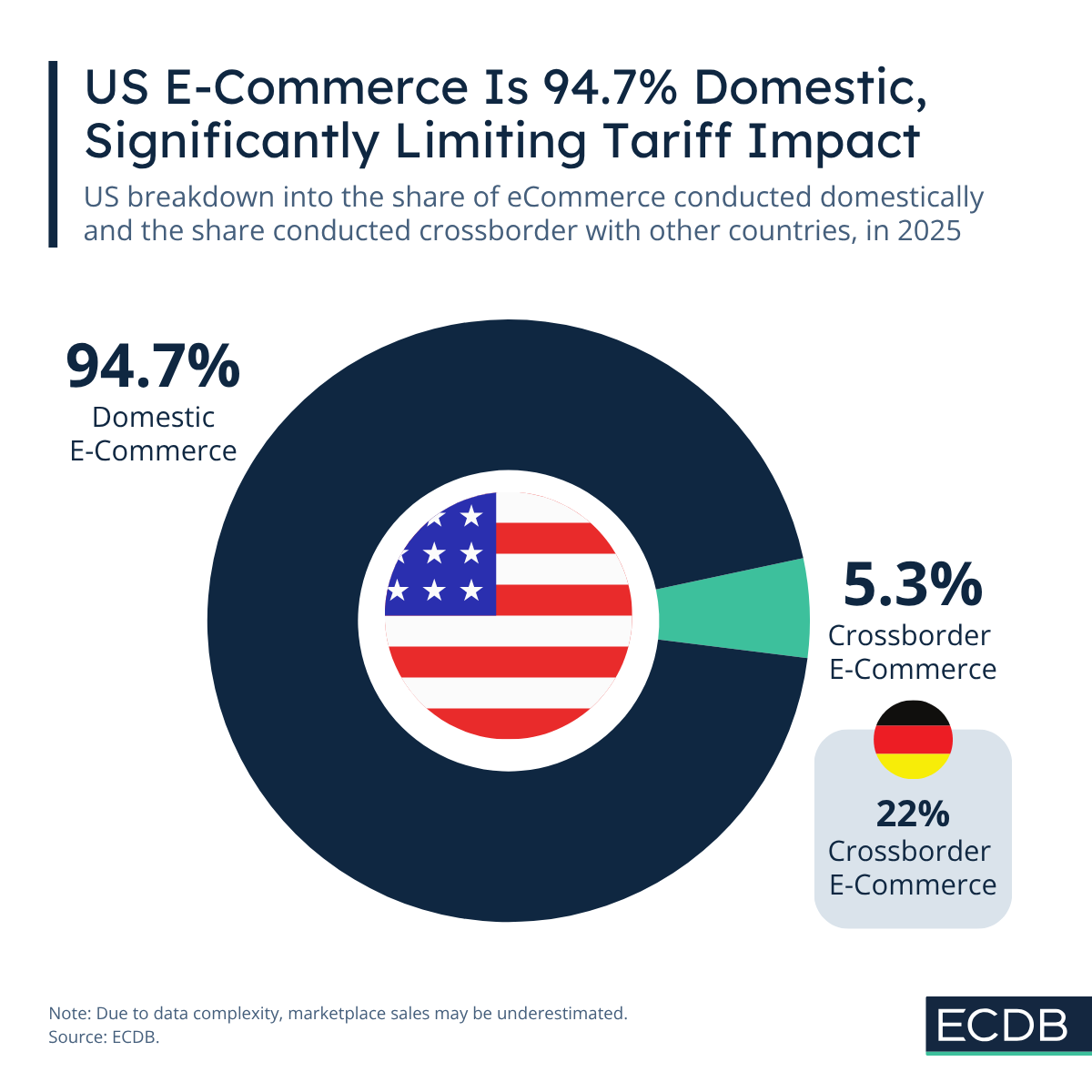

With 94.7% domestic sales, the US market remains relatively insulated despite geopolitical pressure.

A Market Reshaped by Policy and Consumer Behavior

Chinese sellers remain deeply embedded in Amazon’s marketplace structure and continue to shape category performance across the platform. Their competitive edge in pricing, manufacturing, and marketplace optimization ensures that they hold substantial shares in some of Amazon’s most important categories.

Despite political pressure and rising import costs, their presence has not diminished—instead, several categories still show shares of 50% or more, highlighting the enduring supply-chain interdependence between the US and China.

Tariffs Slow the Market: The 2025 Outlook Drops by 1.5%

Throughout 2024 and early 2025, US tariff policies have been tightened, pushing up import costs across categories such as electronics, apparel, tools and home goods.

These changes ultimately reduce the 2025 e-commerce outlook, though the impact remains contained due to the market’s domestic-heavy structure.

ECDB’s revised projections now show a 1.5% downward adjustment for 2025—reflecting both policy effects and shifting consumer demand.

US Retailers Gain the Most as Shoppers Turn Away From Temu and Shein

A defining shift of late 2025 is the churn among Temu and Shein shoppers. Millions of consumers are reconsidering ultra-low-priced marketplaces due to concerns over shipping reliability, product durability or sustainability.

As a result, a diverse group of US retailers—from value-oriented chains to premium brands—are capturing significant numbers of returning shoppers. This signals a structural correction in the fast-fashion segment and the early rise of up-trading behavior.

Why the US Market Remains Stable Despite Tariffs

One of the main reasons tariffs have not caused widespread disruption is the overwhelmingly domestic nature of US e-commerce.

With 94.7% of all online spending taking place within the US, the market is naturally insulated from international volatility.

Cross-border activity remains minimal compared to other global markets, allowing US retailers to maintain pricing power and operational stability even as global conditions tighten.

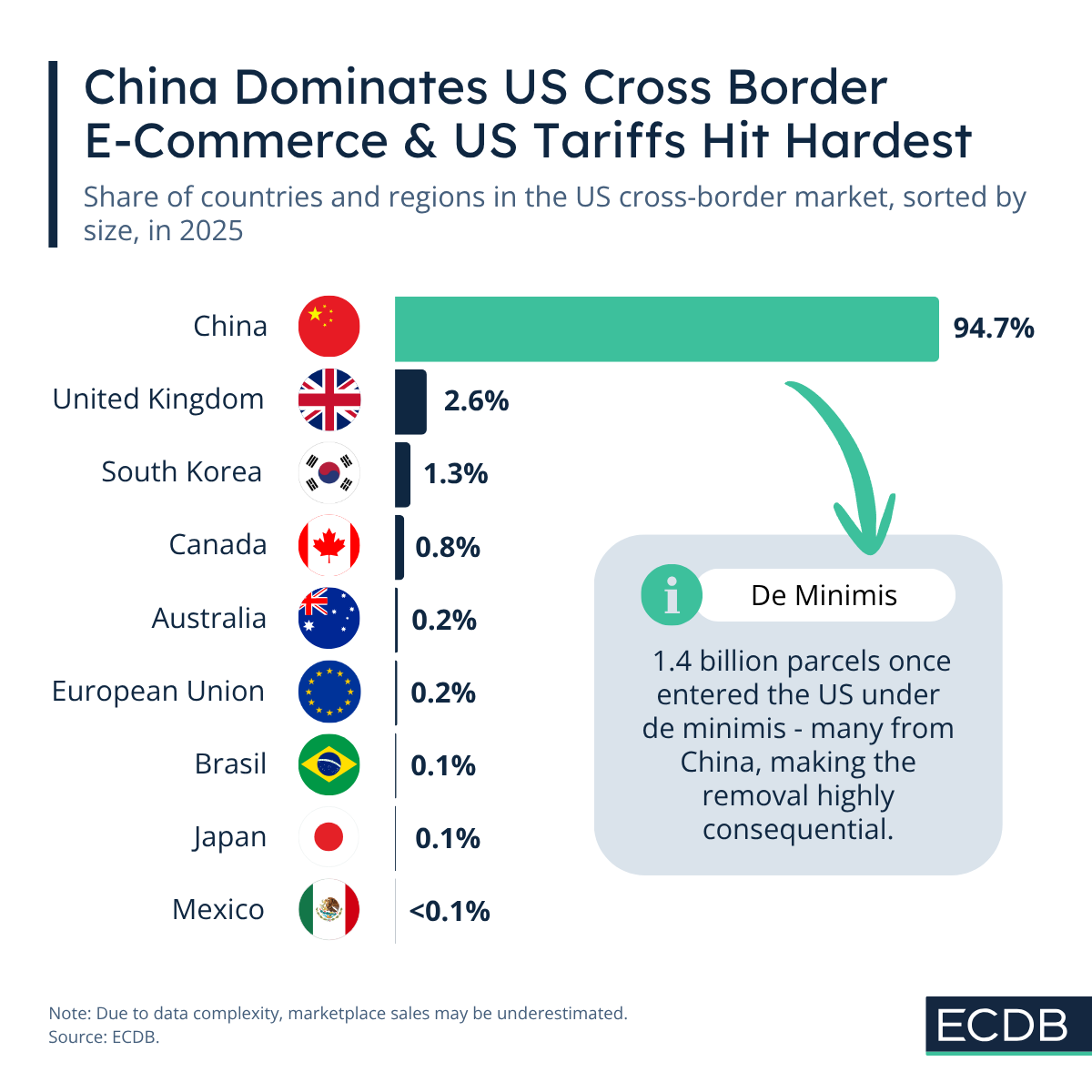

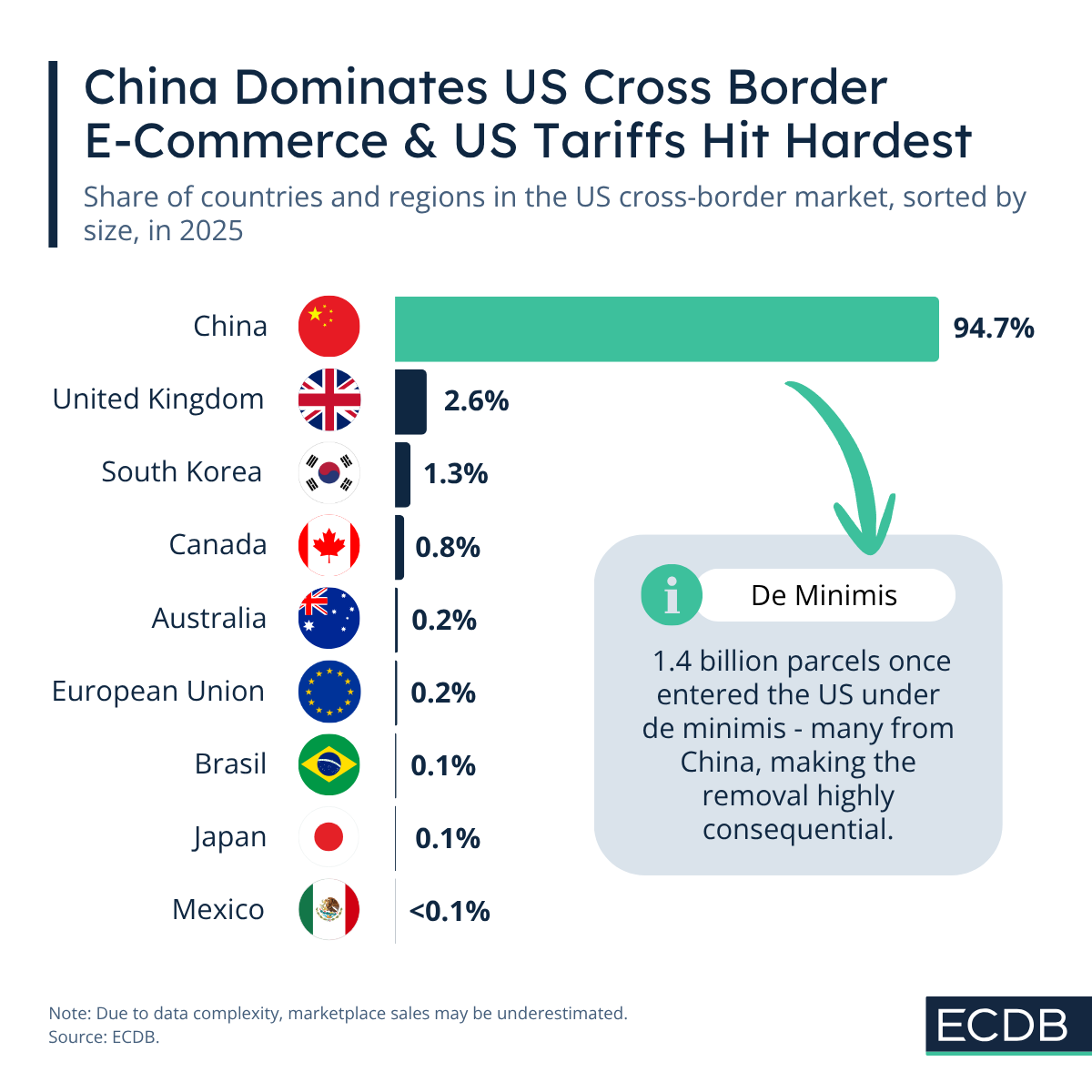

Cross-Border Sales Are Small—but Almost Entirely Dependent on China

Although cross-border e-commerce makes up only a small portion of total US online spending, it is extremely concentrated: China accounts for nearly all of it.

This makes tariff measures especially impactful for Chinese sellers and for US consumers accustomed to low-priced imports.

The end of the de minimis exemption—previously allowing many China-origin packages to enter duty-free—marks a structural shift in cost dynamics, particularly for low-value goods.

Looking Ahead: Navigating Uncertainty in 2026

The closing months of 2025 underline a defining reality: uncertainty has become a structural part of the US e-commerce ecosystem. Tariffs, shifts in consumer loyalty and deep marketplace dependencies are reshaping competitive positions at an accelerating pace. Yet the market continues to demonstrate resilience—supported by a predominantly domestic sales base and reinforced by renewed momentum among established US retailers.

As the industry transitions into 2026, success will depend on how well retailers can adapt to volatility. Those with strong supply-chain control, clear value propositions and credible brands will be best positioned to navigate an environment where policy shifts, pricing pressures and evolving shopper expectations remain constant forces. In uncertain times, strategic clarity becomes the strongest competitive advantage.