The U.S. President Donald Trumps ended the de minimis tariff exemption this year. Together with a new tariff categorization, these new measures aim at fending off cheap cross-border competition. But the strategy is being hotly debated. The main concern is that smaller businesses and consumers will bear the brunt of this policy.

At ECDB, we calculated our own projections. What effect will the abolition of de minimis, combined with higher tariffs, have on U.S. eCommerce?

What Is De Minimis, and Why Was It Abolished?

The de minimis rule was established as a U.S. tariff exemption rule in 1938 to reduce bureaucracy for small imports valued under US$800. Over time, businesses began using this exemption as a way to arbitrage costs by shipping smaller packages in bulk through U.S. customs.

This benefited not only low-cost retailers from abroad. The de minimis exemption has been notorious for allowing heavy illicit drugs, such as fentanyl, to enter U.S. territory undetected. Therefore, the reasons for abolishing de minimis regard both consumer protection and benefiting U.S. retail over foreign competitors.

That was the stated intention of this rule. Additionally, there are tariff increases for leading U.S. import partners. They are divided into tariff groups.

How High Are Tariffs Now? What Is Their Background?

Most of the tariffs were implemented at the beginning of August, but some have changed since then. Especially China regularly receives threats of tariff increases of up to 100%, but it is by no means the only country affected by this uncertainty.

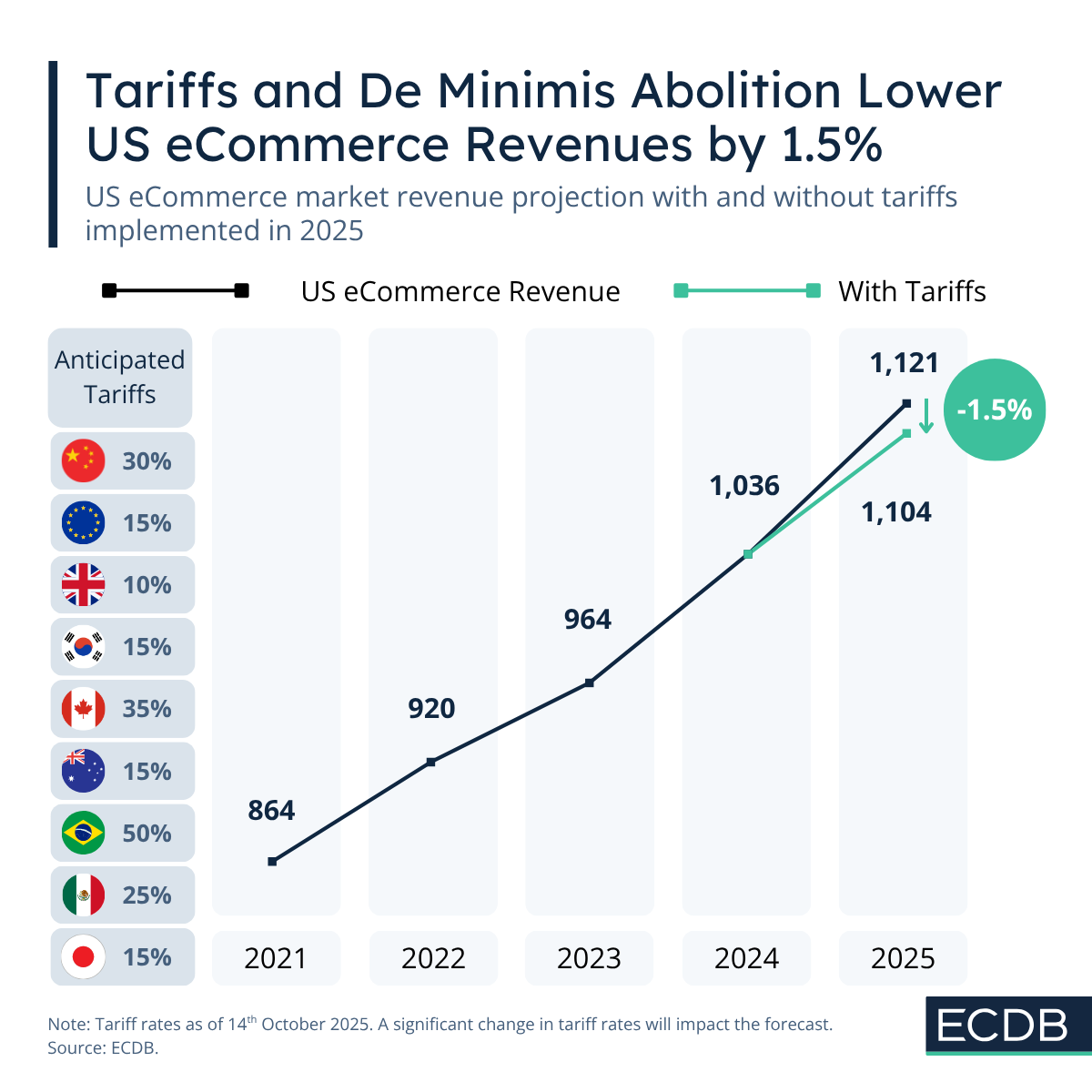

As of today, October 14, 2025, tariffs on Chinese products are set at 30%. However, recent news has speculated about a 100% penalty rate should China continue its current licensing of rare-earth materials. If the penalty rate is added, it will significantly impact our forecast on tariff effects.

The European Union agreed on a rate of 15%, similarly low as South Korea, Australia and Japan. The United Kingdom receives a lower rate of 10%, though there are exceptions and separate tariffs for other product categories.

The United States' neighbors, Canada and Mexico, were hit especially hard by tariffs. Their proximity and frequent commercial exchanges have led to tough measures, including 25% tariffs on products shipped from Mexico and 35% on those from Canada.

But Brazil has received the highest rate of 50% so far. Public commentary views this move as political retaliation against the incarceration of Trump ally Bolsonaro rather than a purely trade-related policy. Whatever the reason, products from Brazil are now subject to a 50% tariff.

What effects will these tariffs have on the U.S. eCommerce market if they hold true?

Policy Effects on the U.S. eCommerce Market at -1.5%

The projected tariff impact for 2025 is estimated at –1.5% of U.S. eCommerce revenue compared to the scenario without tariffs. One might think this rate is lower than expected. What are the reasons behind this result?

Cross-Border Import Share Is Only at 4.7%

The impact of cross-border sales is not as extensive as expected. According to ECDB’s cross-border sales data, imports account for only 4.7% of the United States' overall eCommerce revenue. Therefore, even if foreign goods become much more expensive, the overall effect on total eCommerce revenue would remain limited.

The Tariffs Affect Only Half of 2025

Since most of the tariffs were implemented in August of this year, only four more months remain. Thus, the effect of the tariffs for the last third of the year is much smaller than for the full 12 months.

Prices for Low-Cost Products Stay Competitive

In particular the products that were targeted by the policy, i.e. low-cost products from Temu, Shein and AliExpress, are only marginally affected by the price increases. Backed by large parent companies, these platforms can absorb part of the additional costs and maintain competitive pricing.

The businesses most affected by the measure are smaller-scale businesses and privately owned single-person entities whose merchandise will get more expensive and who can’t afford the following measure.

Chinese Retailers Already Operate via U.S.-Fulfillment

Since the policy has been under discussion for a long time, the targeted retailers have had time to react. Shein and Temu quickly responded to the imminent abolishment of the de minimis threshold and tariff increases by leveraging U.S. fulfillment. Shein is even cooperating with domestic U.S. retailers.

This puts Shein and Temu on a level playing field with Amazon and Walmart, which also source merchandise from international sellers. The former have an advantage in their immediate feedback model, which allows them to measure demand in real time and adjust production capacities accordingly.

Perspective: A Policy with Symbolic Weight but Limited Immediate Impact

Although the elimination of the de minimis threshold and the introduction of higher tariffs mark a clear political statement toward protecting U.S. manufacturing and tightening import controls, the short-term economic impact on overall eCommerce revenue appears limited.

Data suggests that cross-border imports account for only a small share of total revenues; therefore, the impact of price increases will be low. Additionally, the originally targeted companies have already adapted their operations to comply with the new framework.

Over the longer term, much will depend on whether the new tariffs lead to sustained changes. If they lastingly impact U.S. companies’ sourcing behavior, pricing structures and consumer trust in foreign versus domestic companies, the impact is likely to grow in the coming years.